A Muslim's Guide to ETFs: Compare Halal Funds for 2025

Explore 15 Halal ETFs in 2025. Compare Shariah-compliant funds by size, returns, and fees. Learn how they follow AAOIFI standards with sector screens, ratio filters, and purification for ethical, halal investing.

Explore 15 Halal ETFs for 2025. Compare Shariah-compliant funds by AUM, returns, and fees, and learn how they align with Islamic finance and AAOIFI standards.

Introduction

This Part 2 guide examines 15 Shariah-compliant ETFs for 2025 in detail, reviewing each fund’s expense ratios, assets under management (AUM), portfolio composition, top holdings, and performance history.

In Part 1 of our series, we introduced a list of notable Halal ETFs in 2025. Here, we expand on that overview with a portfolio breakdown and financial insights that describe how different funds operate within the framework of Shariah principles.

Whether focused on U.S.-based Islamic ETFs, global Shariah-compliant funds, or fixed-income Sukuk ETFs, this article outlines the available options and how they align with AAOIFI standards and Islamic finance frameworks.

ETFS Breakdown

1. SPUS – SP Funds S&P 500 Sharia Industry Exclusions ETF

SPUS is a Shariah-screened ETF that offers exposure to the U.S. stock market by excluding industries commonly considered non-compliant under Islamic finance screens. It tracks the S&P 500 Index, but carefully excludes industries that are not Shariah-compliant, such as alcohol, gambling, and conventional finance.

- Expense Ratio: 0.45%

- Assets Under Management (AUM): $1.51 billion

- 1-Year Performance (YTD): +8.34%

- 1-Year total Return: +14.89%

Portfolio Composition

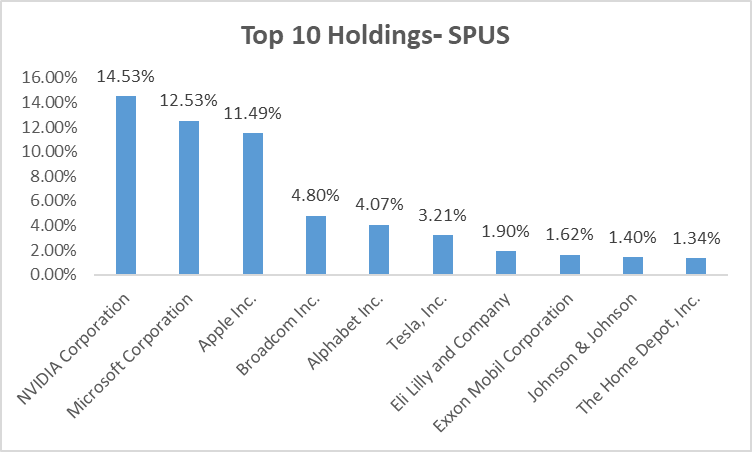

SPUS holds around 215 Shariah-compliant stocks, with a strong bias toward U.S. technology leaders. Nearly 57% of the portfolio is concentrated in the top 10 holdings, as of Aug 29, 2025:

- NVIDIA (14.53%)

- Microsoft (12.53%)

- Apple (11.49%)

- Broadcom (4.80%)

- Alphabet (4.07%)

Key Insight

SPUS has a significant concentration in U.S. technology companies, which some investors associate with growth exposure.

2. IGDA – Invesco Dow Jones Islamic Global Developed Markets UCITS ETF

The IGDA ETF offers investors broad exposure to developed markets across the world, while maintaining strict Shariah compliance. It tracks the Dow Jones Islamic Market Developed Markets Index, excluding non-compliant industries.

- Expense Ratio: 0.40%

- Assets Under Management (AUM): $761.52

- 1-Year Performance (YTD): +7.62%

- 1-Year total Return: +10.29%

Portfolio Composition

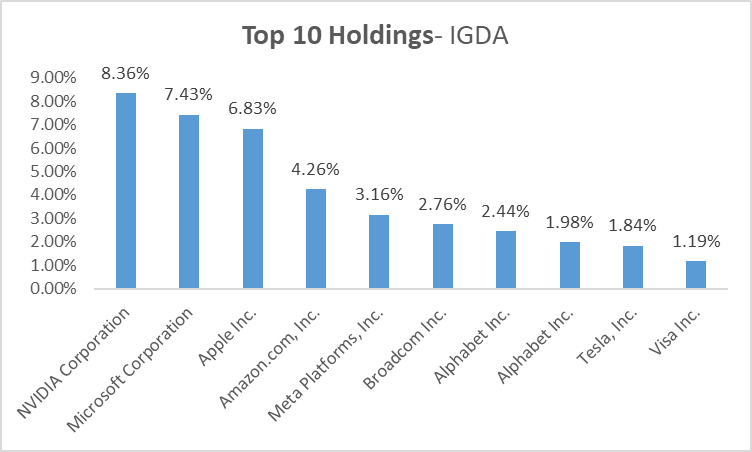

With 1,529 holdings, IGDA is highly diversified. The top 10 holdings (~40.51% of the portfolio) as of Aug 29, 2025, include:

- NVIDIA (8.36%)

- Microsoft (7.43%)

- Apple (6.83%)

- Amazon (4.26%)

- Meta Platforms (3.16%)

Key Insight

IGDA provides exposure to developed markets beyond the U.S., with holdings in leading tech and consumer companies.

3. ISDW – iShares MSCI World Islamic UCITS ETF

The ISDW ETF provides exposure to global developed markets, while filtering out companies that fail Islamic finance criteria. It is one of the most accessible Halal ETFs for broad equity coverage.

- Expense Ratio: 0.30%

- Assets Under Management (AUM): $596.42 million

- 1-Year Performance (YTD): +7.59%

- 1-Year total Return: +10.29%

Portfolio Composition

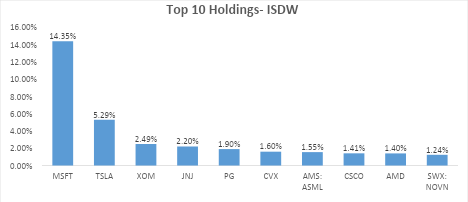

ISDW includes 457 individual holdings, with the top 10 (~33.43% of portfolio) dominated by major global leaders as of Aug 26, 2025.

- Microsoft (14.35%)

- Tesla (5.29%)

- Exxon Mobil (2.49%)

- Johnson & Johnson (2.20%)

- Procter & Gamble (1.90%)

Key Insight

Investors believe that ISDW provides global exposure at a moderate cost, with a balanced sector mix and geographic spread.

4. HLAL – Wahed FTSE USA Shariah ETF

The HLAL ETF by Wahed is a U.S.-focused Islamic ETF that mirrors the FTSE USA Shariah Index. It delivers exposure to American large- and mid-cap stocks while excluding non-compliant sectors.

- Expense Ratio: 0.50%

- Assets Under Management (AUM): $662.76M

- 1-Year Performance (YTD): +6.76%

- 1-Year total Return: +10.41%

Portfolio Composition

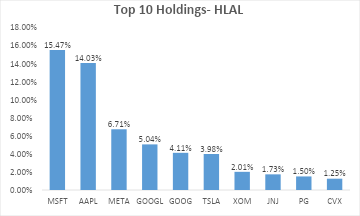

HLAL holds 211 companies, with a strong concentration in U.S. tech leaders. The top 10 (~55.83% of portfolio) as of Aug 28, 2025, include:

- Microsoft (15.47%)

- Apple (14.03%)

- Meta Platforms (6.71%)

- Alphabet (5.04% & 4.11% from two share classes)

Key Insight

HLAL is tech-heavy and U.S.-centric, providing exposure to domestic large- and mid-cap equities within Shariah-compliant sectors.

5. ISDE – iShares MSCI Emerging Markets Islamic UCITS ETF

The ISDE ETF gives investors exposure to emerging markets while adhering to Shariah compliance. It provides exposure to markets in Asia and other emerging regions, which some investors seek for higher growth potential.

- Expense Ratio: 0.35%

- Assets Under Management (AUM): $259.52M

- 1-Year Performance (YTD): +18.97%

- 1-Year total Return: +2.74%

Portfolio Composition

ISDE tracks 616 companies across emerging markets. The top 10 holdings (~33.57% of portfolio) as of Aug 29, 2025, include:

- Samsung Electronics (8.91%)

- Xiaomi (4.36%)

- SK hynix (3.96%)

- Reliance Industries (3.52%)

- Hon Hai Precision Industry (3.12%)

Key Insight

ISDE offers diversification outside developed markets, with exposure to Asian tech and Middle Eastern financials.

6. SPSK – SP Funds Dow Jones Global Sukuk ETF

SPSK provides exposure to global Sukuk (Islamic bonds), which some investors view as relatively more stable compared to equities.

- Expense Ratio: 0.50%

- Assets Under Management (AUM): $347.88M

- 1-Year Performance (YTD): +4.50%

- 1-Year total Return: +3.40%

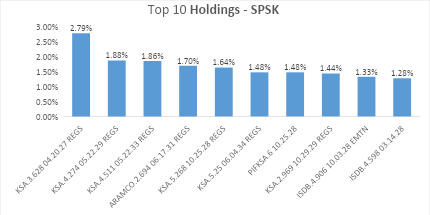

Portfolio Composition

The ETF includes 152 Sukuks issued by sovereign and quasi-sovereign entities. As of Aug 28, 2025, the top holdings are:

- KSA Sukuk Limited 3.63% (2.79%)

- KSA Sukuk Limited 4.27% (1.88%)

- KSA Sukuk Limited 4.51% (1.86%)

- SA Global Sukuk Ltd. 2.69% (1.70%)

- KSA Sukuk Limited 5.27% (1.64%)

Key Insight

SPSK provides access to global Sukuk, which some investors view as relatively more stable compared to equities.

7. WSHR – Wealthsimple Shariah World Equity Index ETF

The WSHR ETF gives investors global equity exposure through a Shariah-compliant lens. It’s a Canadian-listed ETF with a focus on established blue-chip companies that some investors associate with lower volatility

- Expense Ratio: 0.64%

- Assets Under Management (AUM): $277.31M

- 1-Year Performance (YTD): +3.83%

- 1-Year total Return: +2.99%

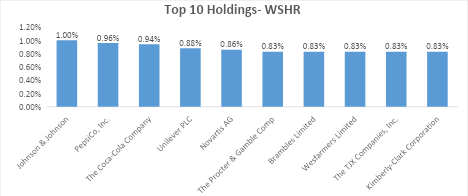

Portfolio Composition

WSHR holds 167 companies, with its top 10 (~8.79% of portfolio) as of Aug 28, 2025, including:

- Johnson & Johnson (1.00%)

- PepsiCo (0.96%)

- Coca-Cola (0.94%)

- Unilever (0.88%)

- Novartis AG (0.86%)

Key Insight

WSHR provides globally diversified exposure with relatively lower volatility compared to some other Halal ETFs.

8. ISDU – iShares MSCI USA Islamic UCITS ETF

The ISDU ETF focuses on U.S.-listed equities that pass Islamic finance screens. It provides a streamlined way to invest in America’s largest Shariah-compliant corporations.

Expense Ratio (TER): 0.30%

Assets Under Management (AUM): $268.61M

1-Year Performance (YTD): +5.39%

1-Year total Return: +9.72%

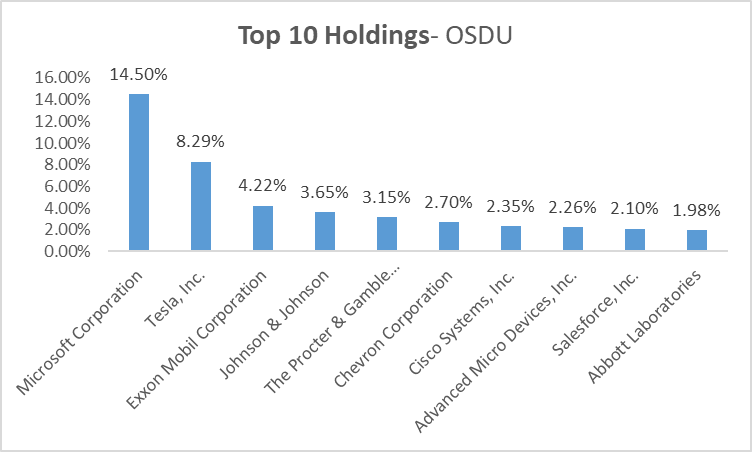

Portfolio Composition

ISDU tracks 136 holdings, with the top 10 (~45.19% of portfolio) dominated by leading U.S. companies as of Aug 29, 2025:

- Microsoft (14.50%)

- Tesla (8.29%)

- Exxon Mobil (4.22%)

- Johnson & Johnson (3.65%)

- Procter & Gamble (3.15%)

Key Insight

ISDU provides exposure to U.S.-listed equities that meet Shariah finance screens.

9. SPRE – SP Funds S&P Global REIT Sharia ETF (Real Estate)

The SPRE ETF offers global REIT exposure and may distribute income through dividends; investors should review its dividend policy and holdings.

- Expense Ratio: 0.50%

- Assets Under Management (AUM): $164.16M

- 1-Year Performance (YTD): -0.47%

- 1-Year total Return: -6.37%

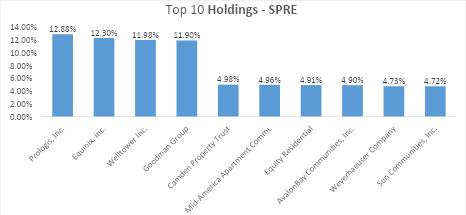

Portfolio Composition

SPRE has 36 holdings, with a high concentration in its top 10 (~78.26%) of the portfolio, as of Aug 28, 2025:

- Prologis (12.88%)

- Equinix (12.30%)

- Welltower (11.98%)

- Goodman Group (11.90%)

- Camden Property Trust (4.98%)

Key Insight

SPRE provides global real estate exposure and dividend yields within a Shariah-compliant framework.

10. UMMA – Wahed Dow Jones Islamic World ETF

The UMMA ETF by Wahed provides broad global coverage of Shariah-compliant equities. It provides exposure to both technology and consumer sectors, with scheduled dividend distributions.

- Expense Ratio: 0.65%

- Assets Under Management (AUM): $153.66M

- 1-Year Performance (YTD): +10.40%

- 1-Year total Return: +2.41%

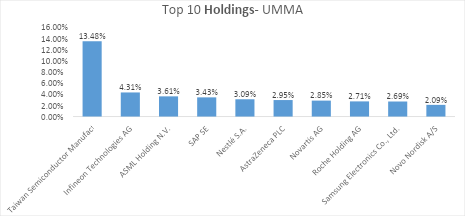

Portfolio Composition

UMMA holds 100 companies, with the top 10 (~41.21% of portfolio) as of Aug 28, 2025, including:

- Taiwan Semiconductor Manufacturing Co. (13.48%)

- Infineon Technologies AG (4.31%)

- ASML Holding (3.61%)

- SAP SE (3.43%)

- Nestlé (3.09%)

Key Insight

UMMA provides broad diversification across technology and consumer sectors, with scheduled dividend distributions.

11. SPWO – SP Funds S&P World (ex-US) ETF (Shariah-compliant International Equity)

The SPWO ETF offers investors exposure to global equities outside the U.S., providing a Shariah-compliant alternative for diversifying internationally.

- Expense Ratio: 0.55%

- Assets Under Management (AUM): $73.52M

- 1-Year Performance (YTD): +13.17%

- 1-Year total Return: +8.90%

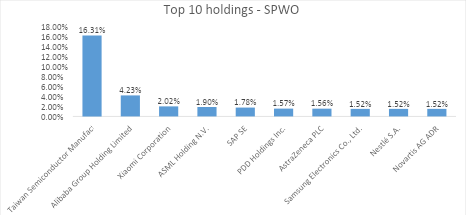

Portfolio Composition

SPWO holds 371 companies, with the top 10 (~33.93% of portfolio) as of Aug 28, 2025, including:

- Taiwan Semiconductor Manufacturing Co. (16.31%)

- Alibaba Group Holding (4.23%)

- Xiaomi (2.02%)

- ASML Holding (1.90%)

- SAP SE (1.78%)

Key Insight

SPWO provides exposure to non-U.S. equities, with dividend distributions included.

12. HIEU – HSBC MSCI Europe Islamic ESG UCITS ETF

The HIEU/ HIPS ETF delivers European equity exposure screened for both Islamic finance rules and ESG (Environmental, Social, Governance) standards.

- Expense Ratio: 0.30%

- Assets Under Management (AUM): $55.84M

- 1-Year Performance (YTD): +1.85%

- 1-Year total Return: -2.50%

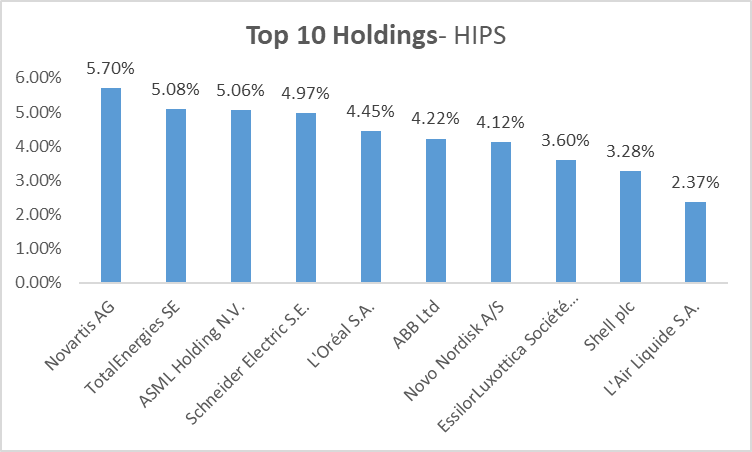

Portfolio Composition

HIES tracks 135 companies, with the top 10 (~42.8%5 of portfolio) as of Aug 29, 2025, including:

- Novartis AG (5.70%)

- TotalEnergies (5.08%)

- ASML Holding (5.06%)

- Schneider Electric (4.97%)

- L’Oréal (4.45%)

Key Insight

HIEU provides European equity exposure with combined Shariah and ESG screening.

13. SPTE – SP Funds S&P Global Technology ETF (Shariah-compliant Tech Exposure)

The SPTE ETF concentrates in technology companies, an allocation that some investors associate with growth exposure.

- Expense Ratio: 0.55%

- Assets Under Management (AUM): $65M

- 1-Year Performance (YTD): +11.26%

- 1-Year total Return: +16.10%

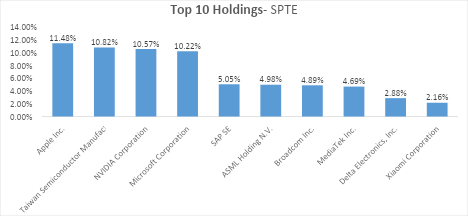

Portfolio Composition

SPTE includes 95 holdings, with the top 10 (~67.76% of portfolio) concentrated in leading global tech firms as of Aug 28, 2025:

- Apple Inc (11.48%)

- Taiwan Semiconductor Manufacturing Company (10.82%)

- NVIDIA Corporation (10.57%)

- Microsoft Corporation (10.22%)

- SAP SE (5.05%)

Key Insight

SPTE offers concentrated exposure to global technology companies within Shariah-compliant sectors such as semiconductors and software.

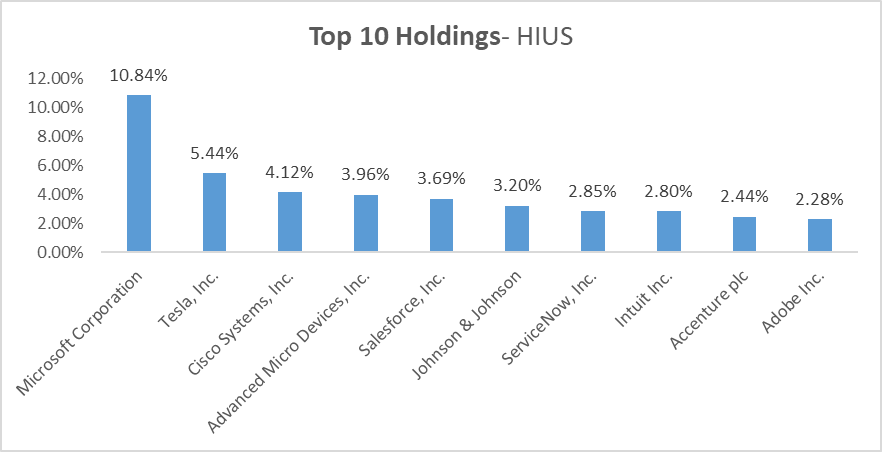

14. HIUS – HSBC MSCI USA Islamic ESG UCITS ETF

The HIUS ETF combines U.S. equity exposure with Islamic and ESG screening, giving investors a responsible investing option within the American market.

- Expense Ratio: 0.36%

- Assets Under Management (AUM): $35.95 M

- 1-Year Performance (YTD): -5.56%

- 1-Year total Return: +3.96%

Portfolio Composition

HIUS includes 125 holdings, with the top 10 (~41.63% of portfolio) as of Aug 29, 2025, including:

- Microsoft (10.84%)

- Tesla (5.44%)

- Cisco Systems (4.12%)

- Advanced Micro Devices (3.96%)

- Salesforce (3.69%)

Key Insight

HIUS provides U.S. equity exposure with combined Shariah and ESG screening.

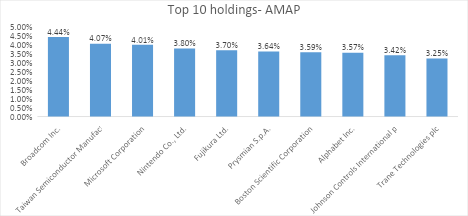

15. AMAP – Saturna Al-Kawthar Global Focused Equity UCITS ETF

The AMAP ETF is an actively managed fund that blends Shariah compliance with ESG principles, providing actively managed global equity exposure within Shariah and ESG frameworks.

- Expense Ratio: 0.75%

- Assets Under Management (AUM): $16.23M

- 1-Year Performance (YTD): +4.50%

- 1-Year total Return: +8.15%

Portfolio Composition

AMAP holds 41 individual holdings, with the top 10 (~37.49% of portfolio) as of Aug 29, 2025, including:

- Broadcom (4.44%)

- Taiwan Semiconductor Manufacturing Co. (4.07%)

- Microsoft (4.01%)

- Nintendo (3.80%)

- Fujikura (3.70%)

Key Insight

AMAP offers actively managed global equity exposure within Shariah and ESG frameworks.

Quick Comparison of Halal Exchange Traded Funds

This section provides a comparison of Halal ETFs in 2025, summarizing key metrics such as assets under management (AUM), expense ratios, and recent performance.

The table below outlines each fund’s characteristics, including size, fees, performance, and sector focus. All listed ETFs follow AAOIFI Islamic finance standards, ensuring Shariah compliance while offering diversification across different markets and asset classes.

| ETF Ticker | Focus Area | AUM (Approx.) | Expense Ratio | 1-Year Return |

|---|---|---|---|---|

| SPUS | U.S. Large-Cap (S&P 500 Sharia) | $1.51B | 0.45% | +8.87% |

| IGDA | Global Developed Markets | $761.52M | 0.40% | +7.62% |

| ISDW | Global Developed Markets | $596.42M | 0.30% | +7.59% |

| HLAL | U.S. Large & Mid-Cap | $662.76M | 0.50% | +6.76% |

| ISDE | Emerging Markets | $259.52M | 0.35% | +18.97% |

| SPSK | Global Sukuk (Islamic Bonds) | $347.88M | 0.50% | +4.50% |

| WSHR | Global Blue-Chips (Canada-listed) | $277.31M | 0.64% | +3.83% |

| ISDU | U.S. Islamic Equities | $268.61M | 0.30% | +5.39% |

| SPRE | Global Real Estate (REITs) | $164.16M | 0.50% | -0.47% |

| UMMA | Global Shariah Equities | $153.66M | 0.65% | +10.40% |

| SPWO | Global ex-U.S. Equities | $73.52M | 0.55% | +13.17% |

| HIEU | European Islamic ESG | $55.84M | 0.30% | +1.85% |

| SPTE | Global Tech (Shariah) | $65M | 0.55% | +11.26% |

| HIUS | U.S. Islamic ESG | $35.95M | 0.36% | -5.56% |

| AMAP | Actively Managed Global Equity | $16.23M | 0.75% | +4.50% |

ETF portfolio data is sourced from StockAnalysis.com as of September 2, 2025.

Shariah Compliance and AAOIFI Standards

After comparing the 15 Halal ETFs for 2025, an important question arises: what exactly makes these funds “Shariah-compliant”?

All of the ETFs reviewed, from U.S.-focused options like SPUS and HLAL to global funds such as IGDA and ISDW, follow a defined set of Islamic investment guidelines. These rules are largely based on the standards set by the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI), which specify the conditions under which a stock can be considered halal.

According to AAOIFI, Shariah-compliant funds must pass three main filters:

- Sector Exclusions: No investment in alcohol, gambling, conventional finance, weapons, or other prohibited industries.

- Financial Ratio Screening: To ensure compliance, ETFs apply financial ratio filters to exclude companies with high leverage or non-compliant income sources. The key thresholds include:

- Interest-bearing debt: Should not exceed 30% of market capitalization.

- Haram income (from prohibited activities): Should be less than 5% of total revenue.

- Interest-earning (non-compliant) investments: Should not exceed 30% of market capitalization.

These limits aim to keep exposure to interest-based financing or prohibited activities at a minimum.

- Purification Process: Any incidental non-compliant income must be donated to charity to ensure returns remain halal.

Conclusion

In 2025, halal investing options continue to expand, with Shariah-compliant ETFs offering access to U.S., global, tech, Sukuk, and real estate markets. These funds apply sector screens, financial ratio filters, and purification processes to align with AAOIFI principles.

For investors seeking to align their portfolios with Islamic finance, reviewing how each ETF applies these standards provides valuable context for understanding both risk and diversification opportunities.

FAQs

Are there any halal ETFs?

Yes. There are over a dozen Shariah-compliant ETFs worldwide, covering U.S. stocks, global equities, Sukuk (Islamic bonds), and even technology or real estate sectors.

Which Shariah ETF options are available?

It depends on your investment objective. Some ETFs track U.S. equities (e.g., SPUS, HLAL), others focus on global diversification (e.g., IGDA, ISDW), income-oriented Sukuk (e.g., SPSK), or technology growth (e.g., SPTE). Each fund has a different focus, and investors should compare based on their own goals and risk tolerance.

Is the S&P 500 ETF halal?

Most conventional S&P 500 ETFs are not Shariah-screened. SPUS, for example, applies sector exclusions and financial filters to align with Shariah screening. Investors should verify an ETF’s current Shariah board oversight and screening methodology.

Is QQQ a halal ETF?

Invesco QQQ is not Shariah-screened. Some investors instead consider Shariah-screened technology ETFs (for example, SPTE), depending on their objectives.

Can Muslims invest in Vanguard?

Vanguard does not currently offer dedicated Shariah-compliant ETFs. However, investors may screen Vanguard funds individually for compliance or choose specialized halal ETFs (such as SPUS, HLAL, or SPSK) that have been certified by Shariah boards.

Are ETFs Shariah-compliant?

Not all. Only ETFs that exclude prohibited industries, meet AAOIFI financial ratios, and purify non-compliant income can be considered halal.

How can I start investing in halal ETFs?

Investors can usually access halal ETFs through major online brokerage platforms like tabadulat, Sarwa ans Zoya, depending on availability in their local market. It’s important to confirm whether the ETF is listed on the investor’s local exchange and reviewed by a recognized Shariah board.

How do Halal ETFs compare to conventional ETFs?

Halal ETFs exclude prohibited sectors such as alcohol, gambling, and conventional finance, while conventional ETFs include all sectors. This makes Halal ETFs more faith-aligned but sometimes less diversified.

Do Halal ETFs pay dividends, and how are they purified?

Yes, many Halal ETFs distribute dividends. Any portion from non-compliant income is purified through donation to charity, ensuring returns remain Shariah-compliant.