Are ETFs Halal? Halal Investing in 2025

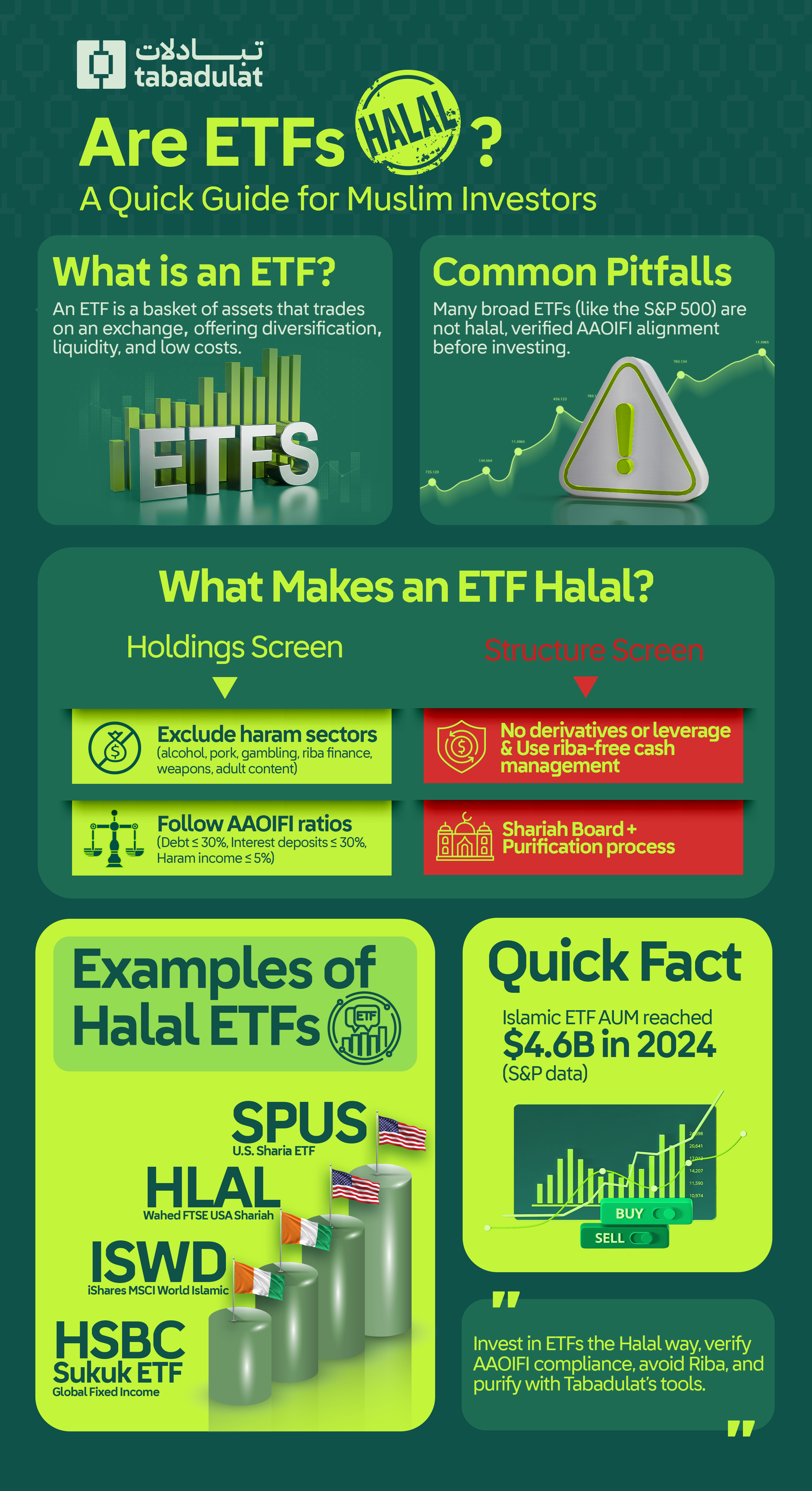

Are ETFs Halal? This guide explains how ETFs work, what makes them Shariah-compliant, and which funds follow AAOIFI standards. Learn the risks, top Halal ETFs, and how Tabadulat helps you screen 40,000+ stocks & ETFs daily for true Islamic investing.

In today’s fast-moving financial markets, many Muslim investors are asking a crucial question: 'Are ETFs (Exchange-Traded Funds) a Halal investment?'

With the growing popularity of ETFs and increasing demand for Halal investing, it’s important to understand this asset class and whether it truly aligns with Islamic finance principles.

On one hand, ETFs offer simplicity, diversification and cost efficiency. On the other, questions remain about their Shariah compliance, particularly regarding the assets they hold and how they’re structured.

In this blog, we break down what ETFs are, explore the key factors that determine their Halal status and assess whether they are a solid investment choice for Muslim investors.

So, What Is An ETF?

An ETF is a basket of securities, like stocks, commodities or bonds, that is listed and traded on a major exchange. ETFs often track major indices like the S&P 500 or the MSCI Index, providing investors with access to an asset classes through a single investment.

ETFs are popular because they offer:

- Diversification: Exposure to multiple companies or assets through one fund.

- Lower Costs: ETFs are typically cheaper than actively managed mutual funds.

- Liquidity: Depending on the ETF, investors can buy and sell during market hours.

For Muslim investors, Shariah-compliant ETFs offer the benefits of portfolio diversification while ensuring investments meet Islamic finance principles. These ETFs are screened and overseen by a Shariah Supervisory Board to ensure they comply with Shariah.

Beyond Halal equities and index-linked ETFs, Muslim investors can also access other asset classes via ETFs, including Sukuk (Islamic bonds), gold, and real estate investment trusts (REITs).

Islamic finance is about managing wealth in a way that aligns with Islamic values. For a detailed guide on Halal investing, read our blog.

Are All ETFs Halal?

The short answer is no. Although a basket of investments may be packaged into an ETF, that doesn’t mean it's automatically Halal.

There are two key important points to consider:

- What assets does the ETF hold or invest in?

- How is the ETF structured and managed?

To figure out if an asset within an ETF is Halal or not, it is necessary to screen its business activities and financial ratios.

For a breakdown of Halal Stock Screening, see our guide on why Halal Stock Screening matters.

Islamic law prohibits investing in certain industries and activities, including:

- Alcohol

- Tobacco

- Gambling and casinos

- Pork products

- Riba-based banking and insurance firms

- Weapons Manufacturing

- Adult entertainment

In addition to activities, companies must also pass financial ratios. Accounting and Auditing of Islamic Financial Institutions (AAOIFI) standards are among the most widely accepted in the Islamic finance industry.

AAOIFI offers a reliable and recognised framework. It enables confident decision-making in line with Islamic ethics. Many major Islamic indices, like S&P and Dow Jones Islamic Market Indices, use AAOIFI criteria.

Want to learn more about AAOIFI standards? See our blog on what makes a stock Halal.

AAOIFI standards highlight that companies should not have:

- Interest-bearing debt exceeding 30% of market capitalisation

- Interest-taking deposits exceeding 30% of market capitalisation

- More than 5% of total revenue from haram activities.

An ETF that holds shares in companies that fail either of these screens would not be considered Halal.

Similarly, an ETF tracking the S&P 500 includes companies that would be in non-compliant sectors. There are Shariah-compliant ETFs that filter non-compliant companies. The SP Funds S&P 500 Shariah Industry Exclusions is the Shariah-compliant version of the S&P 500.

ETF Structure

Even if the underlying assets are Halal, the ETF’s structure also needs to comply with Islamic finance principles.

Investors should consider the following:

- Use of Derivatives and Leverage: Some ETFs use financial derivatives like options and futures or take on debt to boost returns. These practices involve Gharar (excessive uncertainty) and Riba, both of which are prohibited in Islamic finance.

- Cash Management: How does the ETF handle its cash reserves? Funds should not be placed in Riba-bearing accounts, as this generates non-compliant income. Under AAOIFI screening standards, haram income cannot exceed 5%.

- Purification Process: Even Shariah-compliant companies may occasionally earn small amounts from non-compliant sources. A truly Halal ETF should have a clear purification process to cleanse this income, usually through charitable donations.

Islamic ETFs may also have higher expense ratios compared to conventional ETFs due to the added costs of Shariah audits and certification.

Additionally, while some ETFs market themselves as Halal, the exact Shariah standards used can vary between providers and jurisdictions. It’s important to check whether the fund follows recognised frameworks like AAOIFI.

Popular Shariah-compliant ETFs

Islamic ETFs have experienced steady growth and popularity, particularly in regions like the Middle East, North Africa, and Southeast Asia. Assets under management of ETFs linked to Islamic Indices have grown to $4.6 billion in 2024, according to an S&P report.

However, compared to the conventional ETF space, the Shariah-compliant ETF universe remains modest. Nonetheless, popular Shariah-compliant ETFs include:

| Halal ETF | Features |

|---|---|

| SP Funds S&P 500 Shariah Industry Exclusions ETF (SPUS) | Tracks a Shariah-compliant version of the S&P 500. |

| Wahed FTSE USA Shariah ETF (HLAL) | Focuses on Shariah-compliant US companies. |

| iShares MSCI World Islamic UCITS ETF | Provides global exposure to Shariah-compliant stocks. |

| HSBC Global Funds ICAV - Global Sukuk UCITS ETF | Offers access to a diversified portfolio of investment-grade Sukuk. |

How Can You Buy Halal ETFs?

At Tabadulat, Shariah compliance is not an afterthought, it’s the foundation of everything we do. We are the world’s first truly global Shariah-compliant brokerage, created specifically for Muslim investors seeking Halal investment opportunities.

We will follow AAOIFI standards, which means every ETF and company we will list, every feature we will launch, and every policy we will implement is centred around Islamic values. We will also adopt an independent Shariah Supervisory Board consisting of the world's most respected scholars who will oversee our activities multiple times a year and issue a Fatwa on the Shariah compliance of our platform.

Through our cutting-edge technology, we will analyse 40,000 stocks and ETFs daily. Similarly, we believe you shouldn’t have to pay extra to know if your portfolio is Halal or not. We will provide a comprehensive Shariah breakdown of your portfolio and prospective investments to every user at no additional cost.

We know markets are not static. So, what happens when your portfolio becomes non-compliant? We’ll notify you immediately to take action. This means you'll be able to focus on investing without compromise.

We understand that Zakat is a key pillar of Islam. That’s why we're creating a built-in Zakat calculator to purify your income and meet your Zakat obligations in one platform! This means your profits are not only financially Halal but also spiritually purified.

Start Investing the Halal Way

Tabadulat will screen 40,000+ stocks and ETFs with real-time Shariah alerts.

Here’s the full, polished FAQ section with all your questions (including the new ones) written in a consistent, conversational tone:

Frequently Asked Questions (FAQs)

What is an ETF?

An ETF is a basket of securities, like stocks, commodities, or fixed-income instruments, that is listed and traded on a major exchange. ETFs often track major indices like the S&P 500 or the MSCI Index.

What makes an ETF Halal?

A Halal ETF must combine Shariah-compliant investments with a Halal operational structure, ensuring both the underlying assets and the fund’s management adhere to Islamic finance principles.

Are ETFs Halal?

Not all ETFs are Halal. Their compliance depends on two key factors: the assets they hold and the way they are structured. To qualify as Halal, ETFs must avoid prohibited sectors, meet AAOIFI financial ratios, and operate without derivatives, leverage, or Riba-based cash management.

How to invest in a Halal ETF?

Use Tabadulat’s free Halal Stock Screener to screen ETFs. We analyse over 40,000 stocks and ETFs globally each day and follow AAOIFI standards to ensure proper Shariah certification, purification, and ongoing compliance monitoring.

Are gold ETFs Halal?

Gold ETFs can be Halal if they are physically backed by real gold and provide actual ownership rights. Gold ETFs based on derivatives or paper contracts would not meet Shariah requirements.

Is the S&P 500 ETF Halal?

An ETF tracking the S&P 500 would likely include non-compliant companies. However, there are Shariah-compliant versions like the SP Funds S&P 500 Shariah Industry Exclusions ETF. Use Tabadulat’s Halal Stock Screener to identify the latest Halal ETFs.

Do I pay Zakat on an ETF?

Yes, Zakat is due on Halal ETFs if they are held as investments, since they represent underlying assets like stocks or commodities. At Tabadulat, we provide a built-in Zakat calculator to help purify your income and fulfil your obligations with ease.

Which Halal ETF is best?

The best Halal ETF isn’t about a single fund—it’s the one that’s properly screened, Shariah-compliant, and fits your investment goals. Some popular options include SP Funds S&P 500 Shariah Industry Exclusions (SPUS), Wahed FTSE USA Shariah (HLAL), iShares MSCI World Islamic UCITS, and HSBC Global Sukuk UCITS ETF.