Green Sukuk Building a Sustainable Islamic Economy

Explore how Green Sukuk blend Islamic finance with sustainability. Discover how Shariah-compliant investments fund renewable energy, green infrastructure, and eco-friendly projects, building a global, ethical Islamic economy aligned with the UN’s climate goals.

The global community faces an urgent need to address climate change and environmental degradation. As nations strive to meet their commitments under the Paris Agreement and achieve the United Nations Sustainable Development Goals (SDGs), innovative financing mechanisms have become essential.

Green finance is a powerful tool for directing capital to environmentally friendly projects. In 2024, about $180 billion in sukuk was issued. Analysts project the sukuk market could approach $1 trillion in cumulative issuance within the next few years (World Bank, 2024).

Mobilizing capital for sustainable finance

Long-term economic growth is a key objective for nations navigating modern challenges and opportunities. In both emerging markets and advanced economies like the United States, developing robust financial markets and capital market infrastructure is essential. Islamic banks, alongside central banks and other financial institutions, play a crucial role in mobilizing capital for sustainable finance and economic growth. Their adherence to Shariah-compliant principles ensures that financial instruments, whether sukuk or other offerings, meet the ethical requirements of Islamic law.

As Saudi Arabia and other leading countries show, integrating renewable energy, green Sukuk, and Shariah-compliant products can help build a resilient, sustainable future that supports United Nations objectives and fosters prosperity across the Islamic world and beyond. While conventional bonds remain important globally, the rise of green and Sharia-compliant alternatives marks a significant evolution in sustainable finance. Islamic finance has responded to these challenges by offering green sukuk. These Shariah-compliant investments unite ethical finance and environmental responsibility, connecting Islamic finance with efforts to address climate change.

Understanding Green Sukuk: Where Faith Meets Sustainability

Green sukuk represents a specialized form of Islamic financial certificate designed exclusively to fund environmentally beneficial projects. Sukuk certificates are different from regular bonds. Regular bonds earn money through interest payments, which Islamic law prohibits, known as riba.

Instead, sukuk certificates show partial ownership in real assets. These assets can include renewable energy facilities, sustainable infrastructure, or green buildings.

The idea gained popularity after Malaysia issued the first green sukuk in 2017, which helped finance large solar power plants. Since then, green sukuk has become a significant segment of the Islamic capital markets. Green and sustainable sukuk now make up about 10% of the total sukuk market, showing strong growth and investor interest in this ethical financing tool (World Bank, 2024).

Purpose and Emergence: Bridging Multiple Worlds

Green sukuk serves three critical purposes. First, it mobilizes capital for climate-resilient and environmentally sustainable projects, including renewable energy, clean transportation, sustainable water management, and green buildings. Second, it provides Muslim-majority countries and Shariah-conscious investors with an ethical pathway to participate in global climate finance. Third, it demonstrates that financial returns and environmental responsibility are not mutually exclusive.

The global sukuk market reached $1.21 trillion in 2024, with total issuance of approximately $180 billion during the year. Leading jurisdictions included Malaysia, Saudi Arabia, the UAE, and Indonesia, which together dominate the market. The rise of green sukuk shows a natural change (Sukuk Market Report, 2025).

Islamic finance principles emphasize the importance of environmental stewardship. They also stress social responsibility and view humans as trustees (khalifah) of the Earth.

Shariah Compliance and the Maqasid Al-Shariah Framework

What distinguishes green sukuk from conventional green bonds is its dual compliance requirement. Green sukuk must adhere not only to international environmental standards but also to Islamic legal principles (Shariah). This creates an additional layer of governance that directs proceeds toward projects aligned with both environmental sustainability and Islamic values.

Green sukuk are closely linked to Maqasid Al-Shariah, which are the main goals of Islamic law. These goals include protecting life, wealth, and the environment. Islamic teachings highlight caring for the planet and avoiding harm, so green sukuk fit naturally with these values.

The CIBAFI (General Council for Islamic Banks and Financial Institutions) Sustainability Guide has created a new framework. This framework adds ESG to the Maqasid Al-Shariah.

It outlines goals for Human Life, Economic, Environmental, Societal, and Governance objectives. This framework ensures that green sukuk issuances are not only Shariah-compliant but also environmentally responsible. They also support the goals of Islamic law by promoting social well-being and protecting the environment.

ESG Sukuk and Islamic Principles: A Perfect Alignment

Green sukuk is part of a broader category known as ESG sukuk. This group also includes social sukuk and sustainability sukuk.

ESG sukuk is growing fast, albeit from a low base. In 2020, issuers sold $4.8 billion of ESG sukuk. In 2024, that figure had risen to $15.2 billion (LSEG, 2025).

The alignment between ESG principles and Islamic finance is profound. Both frameworks emphasize:

Negative Screening: Excluding investments in activities harmful to society or the environment, such as fossil fuels, alcohol, gambling, and tobacco. Islamic finance has practiced negative screening for centuries, making the transition to ESG sukuk seamless.

Positive Impact: Directing capital toward projects that generate measurable environmental and social benefits, consistent with the Islamic principle of maslahah (public interest).

Stakeholder Welfare: Considering the impact on communities, workers, and future generations, reflecting the Islamic emphasis on social justice and intergenerational equity.

Transparency and Accountability: Both frameworks require robust reporting on how funds are utilized and their impact. This aligns with Islamic principles of amanah (trustworthiness) and accountability.

In April 2024, the Islamic Development Bank, International Capital Market Association, and London Stock Exchange jointly published guidance on green, social, and sustainability sukuk. This effort aims to connect Islamic finance with regular ESG investors. It makes green sukuk more accessible to a wider range of investors.

Leading Countries in Green & ESG Sukuk Issuance

Several countries have emerged as leaders in the green sukuk market, each contributing uniquely to its development:

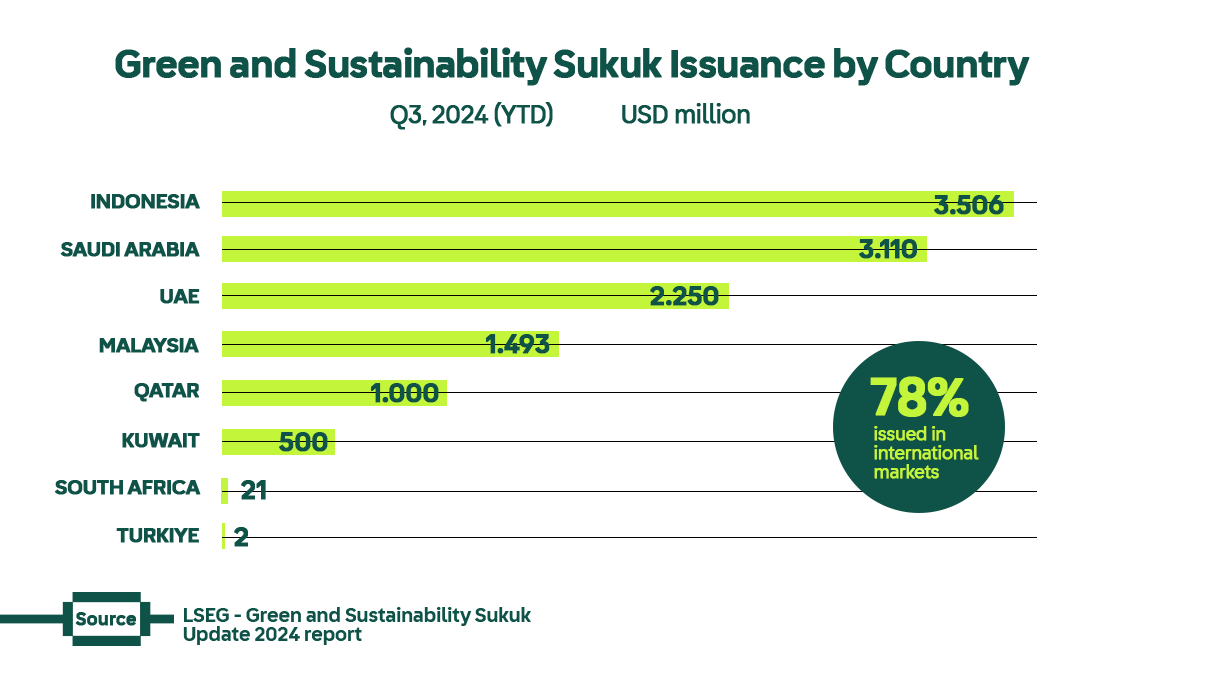

Malaysia: As the pioneer, Malaysia issued the world's first green sukuk valued $59 million in 2017. The country issued US$1,493 million in green and sustainability sukuk by the third quarter of 2024.

Indonesia: While Malaysia leads in volume of issuances, Indonesia has raised the most capital through green sukuk. As the world's most populous Muslim nation, Indonesia issued its first sovereign green sukuk of $1.25 billion in March 2018. Indonesia led the world with US$3,506 million in green and sustainability sukuk issuance in the first nine months of 2024.

Saudi Arabia: The Kingdom has emerged as a major player in sustainable sukuk, coming after Indonesia with US$3,110 million in green and sustainability sukuk issued in the first nine months of 2024. Saudi Arabia's Vision 2030 economic transformation program drives significant infrastructure and renewable energy projects, making green sukuk an essential financing tool. The country issued two green sukuk in 2019 and continues to expand its sustainable finance activities.

United Arab Emirates: The UAE has emerged as one of the leading hubs for green and ESG sukuk issuance. In the first nine months of 2024, the UAE issued approximately US$2.25 billion worth of green and sustainability sukuk, positioning it among the top three global issuers, after Indonesia and Saudi Arabia. Major UAE-based institutions such as First Abu Dhabi Bank and Dubai Islamic Bank have been active players, channeling funds into renewable energy, sustainable infrastructure, and low-carbon projects.

Other Emerging Markets: Qatar participated in the issuance of green sukuk for the first time in 2024, expanding the market to 12 jurisdictions. Other countries showing interest include Turkey, which has been exploring sustainable sukuk options as part of its Islamic finance development strategy.

Recent Issuances in the Middle East (2025)

The year 2025 has witnessed remarkable activity in Middle Eastern green sukuk markets, demonstrating continued growth and diversification:

Islamic Development Bank (IsDB): In October 2025, the IsDB raised €500 million through its latest green benchmark sukuk under its enhanced 2025 Sustainable Finance Framework. This five-year issuance was the Bank's first EUR benchmark of the year and witnessed record-breaking demand, with a five times oversubscription. The Framework added two new categories: Climate Change Adaptation and Food Security and Sustainable Food Systems, reflecting evolving priorities in member countries.

Sobha Realty (UAE): In September 2025, Dubai-based Sobha Realty completed a $750 million green sukuk issuance, marking the largest such issuance by a real estate developer globally. The five-year sukuk attracted $2.1 billion in orders (2.8 times oversubscribed) and was priced at a profit rate of 7.125% per annum. The proceeds will finance projects aligned with ICMA Green Bond Principles and LMA Green Loan Principles, with 56% allocated to regional investors and 44% to international participants.

Binghatti Holding (UAE): In September 2025, Binghatti Holding successfully priced a $500 million three-year green sukuk under its $1.5 billion Trust Certificate Issuance Programme. The issuance was over 4.3 times oversubscribed, with an orderbook exceeding $2 billion, demonstrating strong investor confidence in Dubai's real estate sector and sustainable financing.

Pakistan: In May 2025, Pakistan launched its first Sovereign Domestic Green Sukuk valued at Rs30 billion (approximately $110 million) at the Pakistan Stock Exchange. This three-year sukuk, structured on an Ijarah basis, aims to fund climate-resilient projects, including the construction of three dams. The issuance reflects Pakistan's commitment to increasing Shariah-compliant financing to 14% of its domestic debt portfolio.

These recent issuances demonstrate the growing sophistication of the green sukuk market, with diverse issuers including multilateral development banks, sovereigns, and private corporations all accessing this innovative financing mechanism.

Market Outlook and Future Potential

The outlook for green sukuk is positive. Analysts had projected annual issuance could reach $30–50B by 2025, reflecting strong market expansion, supported by a deeper market, clearer standards, and better investor education. The total sukuk market is expected to reach $3.99 trillion by 2033, with strong yearly growth anticipated.

Several factors support this optimistic outlook:

Regulatory Support: Countries such as Malaysia, Indonesia, and the UAE have developed comprehensive regulatory frameworks and taxonomies that facilitate the issuance of green sukuk, including tax incentives and grant schemes.

Growing Investor Demand: A survey found that 55% of investors plan to invest in green and sustainable sukuk over the next three years, reflecting an increasing awareness of climate risks and opportunities.

Standardization Efforts: The joint guidance published in April 2024 establishes a standardized framework, making green sukuk more accessible to conventional investors unfamiliar with Islamic finance structures.

Economic Transformation: Major net-zero emissions initiatives, such as Saudi Vision 2060 and UAE Vision 2050, require substantial infrastructure financing, creating a natural demand for innovative financing instruments like green sukuk.

Climate Urgency: As the impacts of climate change intensify, the need for climate finance becomes increasingly urgent. Green sukuk offers Muslim-majority countries a culturally appropriate and ethically sound tool to mobilize capital for climate adaptation and mitigation.

Challenges and Opportunities

Despite its potential, the green sukuk market faces several challenges. Limited standardization across jurisdictions creates complexity for issuers. The small size of individual issuances can make it difficult to achieve economies of scale. There is also a need for greater capacity building among issuers and investors to understand both Islamic finance principles and environmental sustainability criteria.

However, these challenges present opportunities. The industry can develop common regional and international standards, expand the investor base beyond traditional sukuk investors to include conventional ESG investors, and leverage digitalization to streamline issuance processes and improve transparency in impact reporting.

Conclusion: A Path Forward

Green sukuk does more than provide financing. They bring together Islamic values and the need to protect the environment. By supporting projects that help the planet and promote fairness, Green sukuk provides an option for investors seeking to align their values with sustainability goals

As the market develops, green sukuk are becoming a preferred option for both Islamic and conventional investors. The large issuances in 2024 and 2025 suggest that more people are now recognizing the value of combining ethical finance with environmental care.

For investors who follow Shariah, green sukuk offer a way to support a cleaner, low-carbon world without giving up their values. Globally, green sukuk help fund renewable energy, eco-friendly buildings, and projects that safeguard the future.

Since Malaysia introduced the first green sukuk in 2017, the market has grown into a multi-billion-dollar success. This demonstrates that faith and sustainability can work together to bring about meaningful change for the planet.

At Tabadulat, we believe financial growth should go hand in hand with sustainability. As a Shariah-compliant trading platform, we help you invest in line with your faith and values. Whether you want green sukuk, ethical stocks, or other halal investments, Tabadulat offers clear tools to help you grow your wealth responsibly.

Sign up for our waitlist today and help build a greener, more just future.

FAQs

What are green sukuk?

Green sukuk are Shariah-compliant financial certificate issued to fund environmentally sustainable projects such as renewable energy, clean transportation, and green buildings. It aligns Islamic finance principles with global climate goals, ensuring ethical, asset-backed, and environmentally responsible investments.

What are Sukuk?

Sukuk are Islamic financial certificates similar to a bond, but structured to comply with Shariah law, which prohibits the charging of interest (riba). Instead of lending money, sukuk holders gain ownership in an underlying asset or project and earn profits generated from its performance, not interest payments.

What are the first green sukuk in the world?

The world’s first green sukuk were issued by Malaysia in 2017, valued at RM250 million (approximately USD59 million). It financed a large-scale solar photovoltaic project, marking a milestone in combining Islamic finance with environmental sustainability.

What are sustainable sukuk?

Sustainable sukuk are a Shariah-compliant instrument used to finance projects with both environmental and social benefits. It supports initiatives like renewable energy, affordable housing, and healthcare, aligning with global sustainability standards and Islamic ethical principles.

Are Sukuk halal or haram?

Sukuk are halal, as they comply with Islamic law by avoiding interest (riba) and speculation (gharar). Instead, it provides investors with ownership in tangible assets or ventures that generate lawful profits through trade, lease, or partnership.

What are green bonds?

Green bonds are conventional debt instruments issued to raise funds for environmentally sustainable projects such as renewable energy, energy efficiency, and waste management. Unlike sukuk, they may involve interest payments, making them unsuitable for Shariah-compliant investors.

For educational purposes only. Tabadulat is not yet licensed or regulated. Past performance is not indicative of future results.