Is Gold a Halal Investment?

Gold holds deep roots in Islam from Qur’anic verses to the Gold Dinar. But is it still halal in today’s markets? Discover how Muslim investors can trade gold ethically through physical gold, ETFs, sukuk, and more, all Shariah-compliant and AAOIFI approved.

Gold has a special place in Islamic history. Halal Gold investment is in the hearts and portfolios of Muslim investors.

From Qur’anic verses that mention Gold and silver as means of trade, to classical Islamic jurists who debated its role as money, Gold has long been viewed as a store of value, a hedge against uncertainty and a legitimate asset in Islamic finance and Halal Investing.

But in a world filled with investment options like halal stocks, halal ETFs, sukuk and digital assets, does Gold still deserve a place in your Shariah-compliant portfolio?

Gold’s Place in Islamic Finance

Gold isn’t just another shiny metal. It holds deep significance in Islam and Islamic finance.

It is one of the six Ribawi items mentioned in Hadith literature, meaning it is subject to strict rules when exchanged. These rules, according to the majority of Islamic scholars, exist to prevent injustice, exploitation and ambiguity in trade.

That’s why Riba, Gharar and Maysir are prohibited in Islamic finance. And it's why many Muslims see Gold as a stable and ethical asset that aligns well with Shariah values.

For a refresher on the basics of Halal Investing, see our blog.

Historically, Islamic civilisations used the Gold Dinar and silver Dirham as currency. Many scholars today still regard physical Gold as a reliable store of value and a means of wealth preservation.

Gold is also mentioned in the Qur’an as a measure of wealth and as a test of character. For example, in Surah Al-Zukhruf (43:33 to 35), Gold is described as a symbol of worldly luxury, reminding believers not to be distracted by material wealth.

In more modern times, Gold Investment in the UAE has a rich history. Before it became a financial metropolis and the UAE became a centre for Islamic finance, the Gold Souk was and still is a key hub for Gold Investment in Dubai.

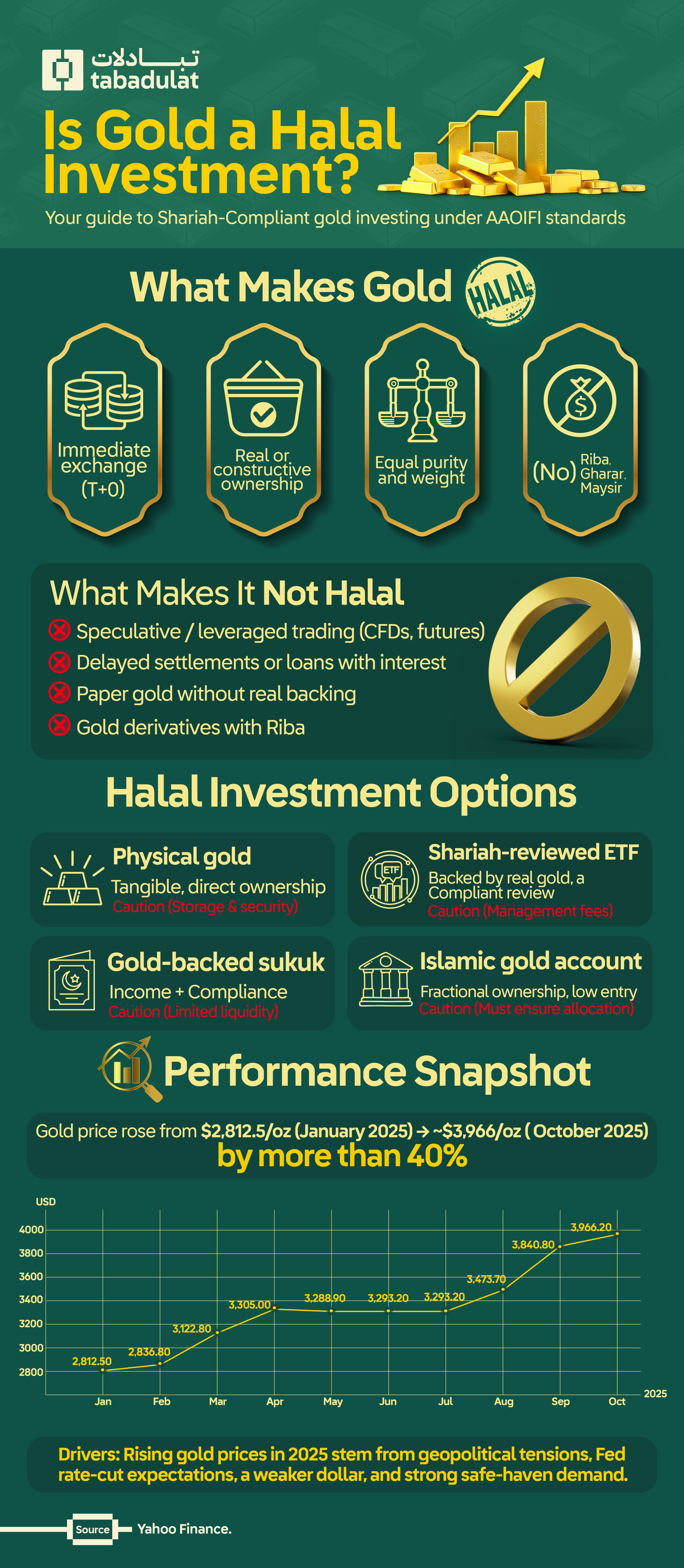

So, is Gold Halal?

The short answer is yes, but only when it is bought and sold in accordance with Shariah.

That said, not all Gold investments are equal.

If you're purchasing physical Gold (like bars, coins or jewellery) with immediate payment and delivery, that’s widely considered Shariah-compliant.

But when it comes to paper Gold, Gold ETFs or derivative-based products, things get more complicated. Some of these involve Riba-bearing instruments, speculative contracts or no real ownership, all of which would be considered non-compliant from an Islamic perspective.

Some scholars and platforms, including Tabadulat, follow AAOIFI standards.

AAOIFI Shariah Standard 57 (co-written with the World Gold Council) requires Gold must be fully owned (either physical or constructive basis), immediately settled, equal in weight and purity as well as completed hand-to-hand to be considered truly Shariah-compliant.

In the case of constructive possession, the gold has to be fully allocated. Allocation can be done through either a T+0 settlement, or the receipt of a certificate or confirmation of specific bar ownership.

For a reminder of AAOIFI standards, refer to our blog.

Gold Investment for the Long Term

Gold’s appeal isn’t just spiritual, it’s also financial.

Between January 2020 and May 2025, Gold prices increased from around $1,520 per ounce on 2 January 2020 to $3,500 per ounce on 22 April 2025. This marks a strong performance given the economic volatility of recent years.

What’s behind this spike? Several factors led to the growth

- Economic uncertainty during the COVID-19 pandemic, geopolitical tensions and conventional banking instability

- Rising inflation and weakening currencies

- Increased demand from central banks and institutional investors

Although Gold doesn’t pay dividends like stocks or rent like real estate, it acts as a hedge against inflation and currency depreciation, protecting portfolios when other assets decline.

That’s why many Muslim investors consider Gold a valuable part of a diversified, Halal portfolio.

How to Trade Gold Halal

If you’re looking to invest in Gold, here are four Shariah-compliant ways to do it:

1. Physical Gold: This includes tangible Gold investment bars, coins or jewellery.

- Pros: Tangible asset, no counterparty risk, historically reliable

- Cons: Storage costs, security risks, no income

To remain Halal, the transaction must involve full payment and prompt delivery. Avoid schemes with delayed delivery or instalment plans that add extra fees. Under AAOIFI, Gold needs to attain a specific level of purity in order to be considered Halal.

To find your local over the counter Gold trader, search for Gold investment near me.

2. Halal ETFs (Gold-Backed) : Some Halal ETFs track the price of Gold and are backed by physical holdings. A few are structured to meet Shariah standards, although you should always verify their Fatwa.

- Pros: Convenient, liquid, easy to trade

- Cons: Management fees, indirect ownership

Always check that the ETF is physically backed, avoids Riba and is approved by a recognised Shariah board. Usually, you can trade Gold-Backed ETFs through an investment app.

Want to learn more about Halal ETFs, see our explainer.

3. Islamic Gold Investment Accounts: Some Islamic banks allow you to open a Gold Investment Account where you accumulate grams of Gold rather than traditional currency. Examples include Maybank Islamic Gold Account and KFH Gold Account.

- Pros: Affordable entry point, real ownership

- Cons: Limited availability, potential fees

Make sure the provider offers full transparency on pricing and Shariah compliance.

4. Gold-Backed Sukuk Some sukuk are structured with Gold as the underlying asset, offering periodic income while maintaining Shariah compliance.

- Pros: Income-generating, asset-backed

- Cons: Limited exposure to the Gold spot price

These are best for investors who want income as well as Halal exposure to Gold.

For a full breakdown on sukuk, see our guide.

What Role Should Gold Play in a Halal Portfolio?

Every investor is different. But broadly, Gold serves three key functions:

- Preserving capital during inflation and uncertainty

- Diversifying risk across asset classes

- Aligning with Islamic values of wealth protection

However, Gold isn’t a growth asset. It doesn’t generate income, and its value can fluctuate based on global demand and currency strength.

That’s why Gold is best seen as a complementary asset, not the core of your Halal portfolio.

Reminders with Halal Gold Investments

Before looking at Halal Gold investments, Muslim traders should be aware of four things:

- Leverage and speculation: Many Gold products (like Contracts for Difference and futures) involve margin trading, which violate Shariah

- No real ownership: Some platforms let you “invest” in Gold without actually owning any physical metal

- Riba-bearing structures: Avoid Gold investments that involve earning or paying Riba

- Under AAOIFI, Zakat of Income from Gold is obligatory when Shariah rules are met.

Gold Investment for Beginners

At Tabadulat, we are the world’s first truly global Shariah-compliant brokerage—built by Muslims, for Muslims.

We follow AAOIFI standards, and every product on our platform will be overseen by an independent Shariah Supervisory Board. This includes Gold-based investments that meet the highest standards of Halal compliance.

We believe Halal-conscious investing should be accessible to all. That’s why we offer:

- Real-time Shariah screening of your portfolio

- Comprehensive reports at no extra cost

- A built-in Zakat calculator to help purify your wealth

- Instant alerts if your portfolio becomes non-compliant

With Tabadulat, you will be able to invest in Gold and other Halal assets with full confidence that your values and your finances are aligned.

FAQs

Is investing in gold halal or haram?

Investing in gold is halal if done according to Shariah principles. Physical gold is permissible when bought with immediate payment and delivery. However, some gold products like futures or margin trades, may involve Riba or Gharar, which are not compliant. For halal investing, focus on physical gold, Shariah-compliant ETFs, or gold-backed sukuk.

Are gold ETFs Shariah-compliant?

Some gold ETFs are Shariah-compliant, but not all. To be halal, the ETF must be backed by physical gold, avoid Riba-based structures, and follow Islamic rules on ownership and settlement. Always check if the ETF has been reviewed or certified by a recognised Shariah board.

What is the AAOIFI standard for gold investment?

Yes! AAOIFI Shariah Standard 57 requires that gold must be physically owned, fully paid for and delivered without delay. It also stipulates that the Gold must be equal in weight and purity as well as allocated. This ensures gold investments follow Islamic principles. Shariah-compliant options include physical gold, an approved ETF, and gold-backed sukuk.

How can Muslim traders invest in gold ethically?

Muslim traders can invest in gold by choosing Shariah-compliant options like physical gold with immediate payment and delivery, approved gold ETFs backed by real assets, Islamic gold investment accounts, or gold-backed sukuk. All investments should avoid Riba, Gharar, and delayed settlement.

What is the difference between halal gold investment and paper gold?

Halal gold investment involves real ownership of physical gold, with immediate payment and delivery. Paper gold usually refers to contracts or products that track gold prices but don’t give actual ownership, and may involve Riba or Gharar. Not all paper gold is Shariah-compliant.