AI Supremacy: Is Meta Stock Halal?

Meta stock soared 12% after record earnings, but is it halal? We break down Meta’s AI growth, financials, and Shariah compliance using AAOIFI standards to help Muslim investors invest with confidence using halal tools like Tabadulat.

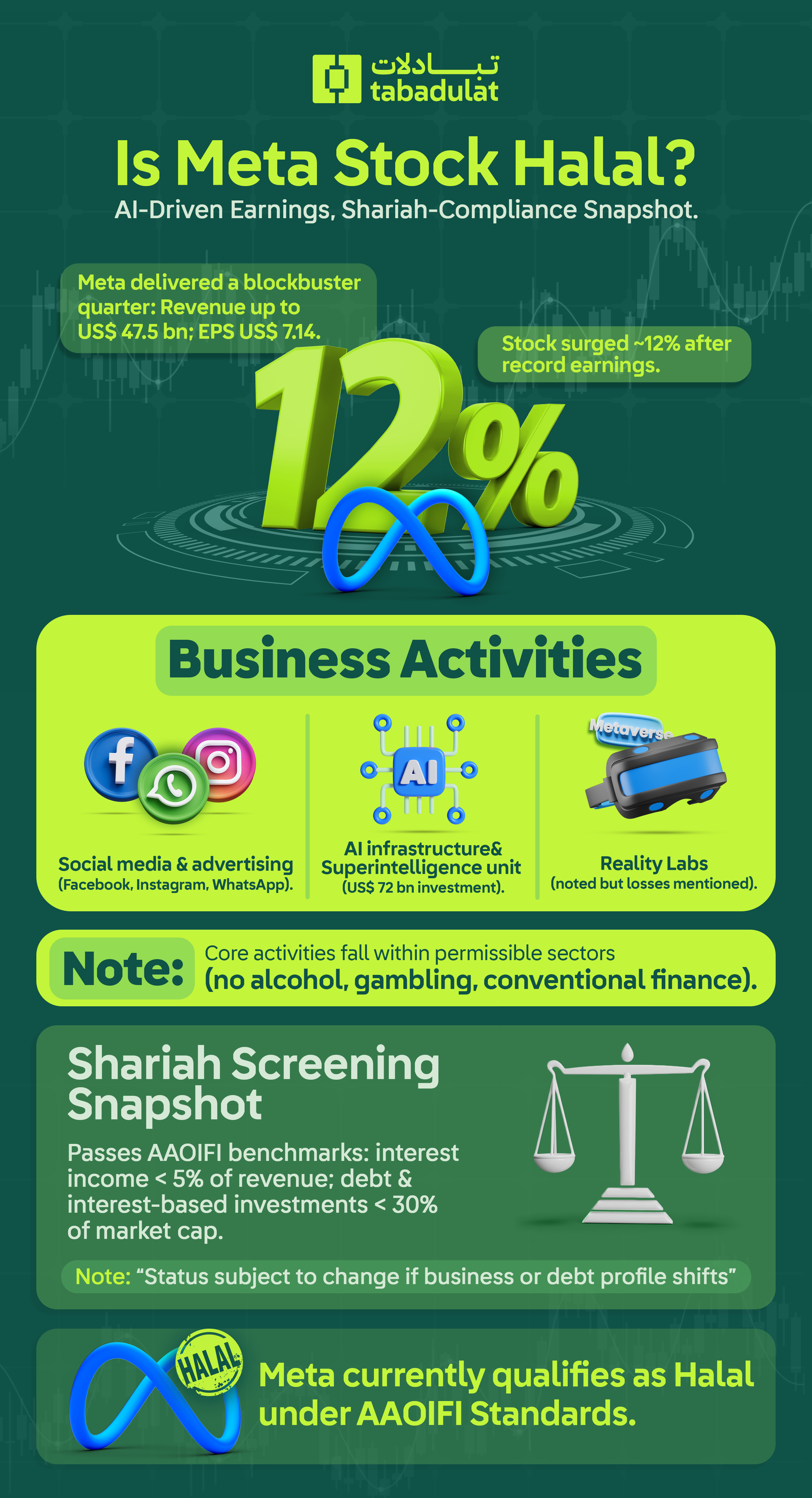

Meta delivered a blockbuster second quarter, with revenue hitting $47.5 billion and EPS at $7.14, far above analyst forecasts. The company’s aggressive AI expansion, including the launch of its Superintelligence unit, fueled investor confidence.

The stock soared 12%, marking one of the year’s most significant single-day gains for a tech giant. Mark Zuckerberg’s net worth surged by nearly $29 billion, reflecting Wall Street’s growing enthusiasm for Meta’s long-term AI vision.

Meta Platforms’ impressive 12% rally has captured the attention of global investors. But for Muslim investors focused on Shariah-compliant investing, one question matters more than any earnings report: Is Meta halal?

At Tabadulat, where Islamic finance meets modern markets, we help you filter through the noise. This article explores Meta’s business model, its Shariah compliance, and how our halal stock screener supports faith-first investing.

Meta’s AI Momentum and Revenue Surge

Meta, parent to Facebook, Instagram, and WhatsApp, has invested $72 billion in AI infrastructure in 2025. This includes data centres, ad algorithms, and content moderation powered by large language models.

The results? Q2 revenue up 22% year-over-year. Net income up 36% to $18.3 billion. Ad conversions surged, and over 2 million advertisers are onboarded.

While its Reality Labs division (focused on VR/AR) continues to post losses, the company’s cash flows remain robust, driven by the Family of Apps.

Shariah Compliance Review

For Muslim investors building a values-based Islamic portfolio, it’s not just about strong returns; it’s about religious compliance.

Meta’s core business, social media and digital advertising, does not involve haram sectors like alcohol, gambling, or conventional financial institutions. But true Shariah compliance also requires passing strict Shariah screening on financial ratios.

Meta stock passes the main AAOIFI Shariah compliance benchmarks. Its interest income is below 5% of total revenue, riba-based debt is under 30% of market cap, and cash plus interest-based investments also remain within the 30% limit, qualifying it as halal for now.

To learn if Uber is a Shariah-compliant investment dive into our analysis of Uber's Shariah Compliance. Where we apply AAOIFI standards to assess its business model, debt, and compliance risks.

Why Real-Time Screening Matters

Even though Meta currently passes, compliance can change quickly. A shift in business focus, a spike in debt, or rising interest income could impact halal status.

That’s why tools like Tabadulat’s halal stock screener are critical, offering real-time insights and automatic alerts across over 40,000 global stocks, ETFs, and financial instruments.

Looking for diversified exposure? Explore halal ETFs and Islamic mutual funds listed on our platform. They offer access to compliant tech stocks, including Meta, while managing risk through structured profit and loss sharing models.

To learn more about halal ETFs and mutual funds explore our full guide to halal ETFs and Islamic mutual funds and see how diversified, Shariah-compliant investing fits into your portfolio.

Shariah-Conscious Investing Strategy

Building a compliant investing strategy isn’t about chasing hype; it’s about balance. Consider how sukuk bonds, tangible asset exposure, and faith-screened financial products can offer income with lower volatility.

Muslim investors in the United States, the Middle East, and beyond are using Tabadulat to blend high-growth opportunities with socially responsible investing principles.

Want a more stable allocation? Learn about Sukuk and Fixed-Income Halal Alternatives.

Conclusion: Meta Today, Halal Tomorrow?

Meta’s AI-fueled growth is impressive, but for those committed to Shariah-compliant investing, momentum alone isn’t enough. True halal investing is rooted in values such as profit sharing, ethical growth, and shared responsibility through risk-sharing, not just performance metrics.

As of now, Meta qualifies as a halal stock under AAOIFI standards. But investment decisions should never be static. They must evolve in response to quarterly data, business activities, and insights from Islamic scholars, especially as the global financial system shifts with the rise of AI and big tech.

That’s why thousands of Muslim investors turn to Tabadulat, a platform built on the principles of Islamic banking to manage their portfolios in an interest-free, ethical way. Whether you’re planning long-term retirement plans or seeking smart exposure to tech, our tools offer clarity, compliance, and confidence.

This 7 min read gave you the key takeaways now, take the next step.

That’s why Muslim investors use Halal stock screeners like Tabadulat, Zoya, and Musaffa to navigate the markets with confidence. But unlike others, Tabadulat is completely free, with no screening fees ever. Track Meta and 40,000+ stocks in real time and build your Islamic portfolio in and interest-free and ethical way.

To learn if Nvidia is Halal for Muslim investors explore our breakdown of Nvidia’s Shariah compliance and see if the AI giant fits within your ethical, Halal portfolio.

FAQs

Is Meta stock halal?

Yes, Meta stock passes the main AAOIFI Shariah compliance benchmarks. Its interest income is below 5% of total revenue, riba-based debt is under 30% of the market cap, and cash plus interest-based investments also remain within the 30% limit, qualifying it as halal for now.

Does Meta have a good future?

Yes, Meta shows strong growth in AI and advertising, with rising revenues and millions of active advertisers. However, Reality Labs still loses money, and future success depends on sustained innovation and user engagement.

Are AI stocks halal?

AI stocks can be halal if the company’s income, debt, and business model meet Shariah standards. Use a halal stock screener based on AAOIFI criteria to verify each company’s compliance individually.

Is it legal to use AI to invest in stocks?

Yes, using AI tools to analyse or trade stocks is legal in most countries. However, users should follow local financial regulations and ensure the tools do not violate ethical or Shariah guidelines.

Can Meta stock hit $1000?

Stock prices are influenced by market sentiment, company performance, and broader economic conditions. While anything is theoretically possible, no one can predict future stock prices with certainty.

Is Meta a good buy?

Whether Meta is a good buy depends on individual investment goals, risk tolerance, and analysis of the company’s fundamentals. It’s important to conduct thorough research or consult a financial professional before making any investment decisions.