Overview of Sukuk Performance Trends in 2025

Discover Sukuk performance trends in 2025. Explore Shariah-compliant, AAOIFI-certified Sukuk funds and Halal ETFs offering ethical, Riba-free investment alternatives for global investors.

Explore Sukuk funds and Halal ETFs in 2025. Discover AAOIFI-compliant, Riba-free, asset-backed options shaping Shariah-compliant ethical portfolios worldwide.

Sukuk Funds and Shariah-Compliant ETFs

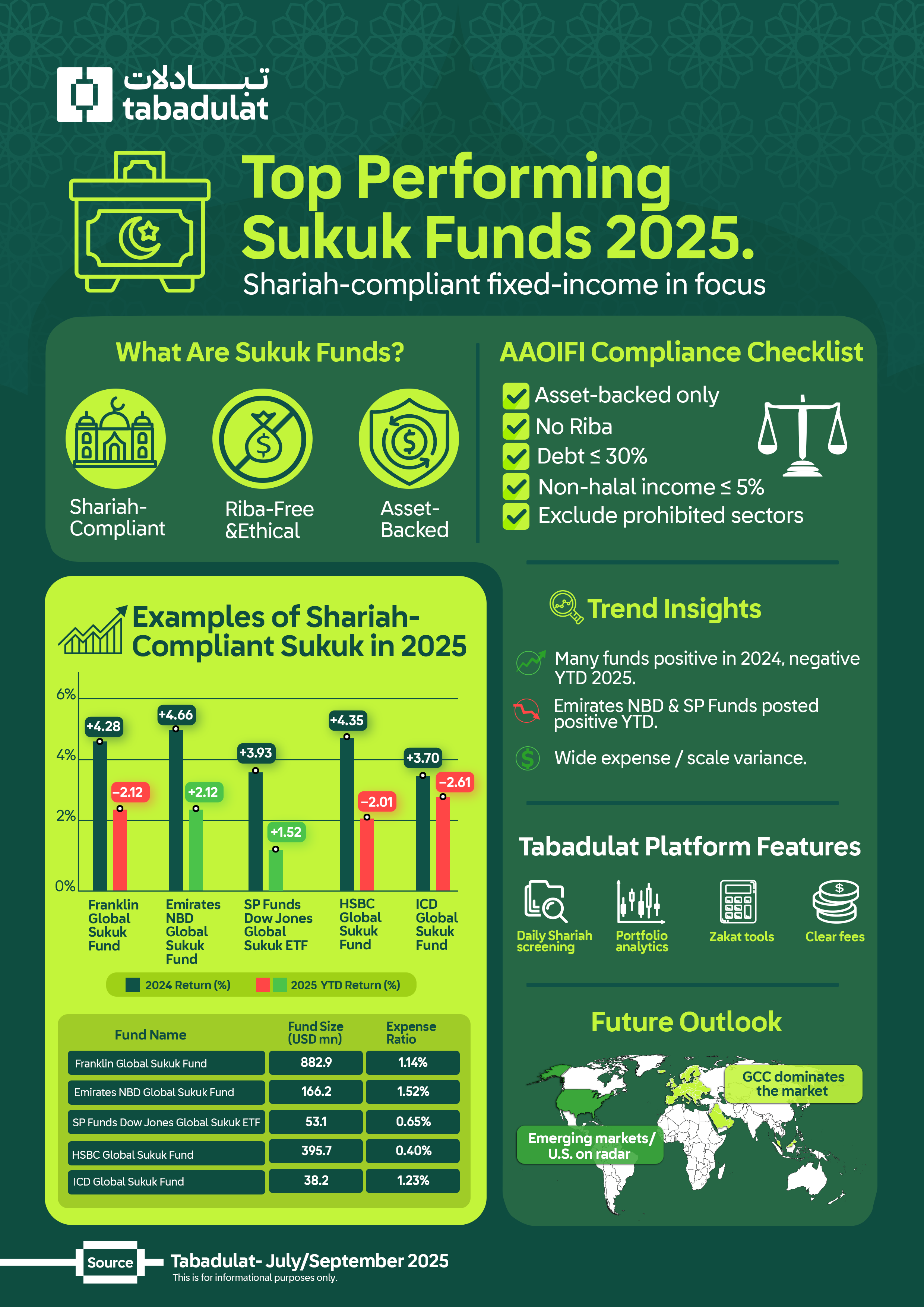

Sukuk funds and Halal ETFs provide alternatives to conventional bonds, offering portfolio diversification and income potential while adhering to Shariah principles. According to the UNDP, Sukuk are increasingly recognized as a global ethical investment tool, particularly in regions such as the GCC, Malaysia, and Europe.

This guide outlines examples of Sukuk featured in 2025, offering an overview of their key features, including fund size, expense ratios, and recent performance, to help investors better understand the range of Shariah-compliant options in the market.

Explore how Sukuk are shaping halal portfolios worldwide. Learn more about Sukuk basics.

Examples of Shariah-Compliant Sukuk in 2025

Here are 10 examples of Sukuk funds and ETFs performance in 2025, listed to illustrate the diversity of options in the market:

- Franklin Global Sukuk Fund

- AZ Multi Asset – Global Sukuk Fund

- Emirates NBD Global Sukuk Fund

- HSBC Global Sukuk Fund

- SEDCO Capital Global Sukuk Fund

- Amana Participation Fund (AMAPX)

- SP Funds Dow Jones Global Sukuk ETF (SPSK)

- Aditum Global Sukuk Fund

- AZ Fund 1 – Global Sukuk Fund

- ADCB Global Sukuk Fund

The following sections provide factual snapshots of these funds, including their fund size (to show scale), expense ratio (to indicate cost levels), 2024 return, and year-to-date (YTD) performance. These details are presented for informational purposes only and do not represent investment advice or endorsements.

Note that all fund data (size, expense ratio, and performance) is based on publicly available reports as of July–September 2025. Figures may vary depending on reporting dates.

1. Franklin Global Sukuk Fund

- Managed by: Franklin Templeton

- Fund size (USD): 656.99m GBP ≈ $882.90M USD (As of Jul 31, 2025)

- Expense Ratio / Ongoing charge: 0.86%

- 2024 Return: +4.17%

- YTD Performance: -2.12% (As of Sep 02, 2025)

The Franklin Global Sukuk Fund is managed by Franklin Templeton and invests in Sukuk across GCC and Asian markets, with a portfolio that includes both sovereign and corporate issuers under AAOIFI Shariah standards.

Its top 5 holdings account for 15.19% of the portfolio, reflecting a moderate level of concentration among issuers.

2. AZ Multi Asset – AZ Islamic – MAMG Global Sukuk A USD Inc

- Managed by: Azimut Group

- Fund size (USD): 421.01M GBP ≈ $566.117 M USD (As of Aug 31, 2025)

- Expense Ratio / Ongoing Charge: 0.97%

- 2024 Return: +6.92%

- YTD Performance: -1.42% (As of Sep 02, 2025)

The AZ Multi Asset – AZ Islamic – MAMG Global Sukuk A USD Inc is a Shariah-compliant fund managed by Azimut Group. The portfolio includes sovereign and corporate Sukuk across different regions, managed in accordance with AAOIFI Shariah standards.

Its top 5 holdings represent 17.16% of the portfolio, giving investors exposure to a set of global issuers that some view as relatively reliable. This fund is structured to generate income while adhering to AAOIFI Shariah standards.

3. Emirates NBD Global Sukuk Fund

- Managed by: Emirates NBD Asset Management

- Fund size (USD): 349 M GBP ≈ $469 M USD (As of Jul 31, 2025)

- Expense Ratio / Ongoing Charge: 1.40%

- 2024 Return:: +2.01%

- YTD Performance: +3.93% (As of Sep 03, 2025)

The Emirates NBD Global Sukuk Fund provides investors with Shariah-compliant exposure to high-quality Sukuk across the Middle East and Asia.

Its top 5 holdings account for 15.17% of the portfolio, striking a balance between concentrated exposure and international diversification. The fund offers exposure to GCC and Asian Sukuk, striking a balance between income and growth characteristics, supported by its regional focus and strong past performance data.

Investors seeking exposure to GCC property-backed Sukuk can learn more about UAE Sukuk market trends.

4. HSBC Global Sukuk Fund

- Managed by: HSBC Asset Management

- Fund size (USD): 282.41M GBP ≈ $379.7 M USD (As of Aug 31, 2025)

- Expense Ratio / Ongoing Charge: 0.40%

- 2024 Return: +4.66%

- YTD Performance: -2.22% (As of Sep 02, 2025)

The HSBC Global Sukuk Fund is managed by HSBC Asset Management and invests in a broad mix of Sukuk from global issuers. Its portfolio covers multiple regions and sectors while maintaining AAOIFI Shariah compliance.

With its top 5 holdings making up 11.26% of the portfolio, the fund prioritizes broad exposure while maintaining quality. Its expense ratio is comparatively lower than some peers, which some investors view as cost-efficient.

This fund provides globally diversified Sukuk exposure with comparatively lower fees..

5. SEDCO Capital Global Sukuk Fund

- Managed by: SEDCO Capital (Saudi Arabia)

- Fund size (USD): 238.22M GBP ≈ $320.27M USD (As of Jul 31, 2025)

- Expense Ratio / Ongoing Charge: 0.75%

- 2024 Return: +4.88%

- YTD Performance: -1.26% (As of Sep 02, 2025)

The SEDCO Capital Global Sukuk Fund is managed by SEDCO Capital in Saudi Arabia and invests in both sovereign and corporate Sukuk across GCC and Asian markets, in line with AAOIFI Shariah standards.

Its top 5 holdings represent 14.65% of the portfolio, striking a balance between concentration and diversification. Some investors view its fees and returns as competitive. It provides exposure to Sukuk with international reach.

6. Amana Participation Fund (AMAPX)

- Managed by: Saturna Capital (United States)

- Fund size (USD): $371.79M (As of Jul 31, 2025)

- Expense Ratio / Ongoing Charge: 0.83%

- 2024 Return: +3.75%

- YTD Performance: +3.25% (As of Jul 31, 2025)

The Amana Participation Fund (AMAPX) is a U.S.-based Sukuk fund managed by Saturna Capital. It invests in Sukuk and Islamic money market instruments, operating under Shariah compliance guidelines.

Its top 5 holdings make up 20.49% of the portfolio, providing targeted exposure to reliable issuers. Some investors in the U.S. use AMAPX for Shariah-compliant fixed-income exposure.

7. SP Funds Dow Jones Global Sukuk ETF (SPSK)

- Managed by: SP Funds (United States)

- Fund size (USD): $333.19M (As of Jul 31, 2025)

- Expense Ratio / Ongoing Charge: 0.50%

- 2024 Return: +2.61%

- YTD Performance: +4.26% (As of Jul 31, 2025)

The SP Funds Dow Jones Global Sukuk ETF (SPSK) is the first U.S.-listed Sukuk ETF. It tracks a globally diversified Sukuk index, offering exposure to multiple regions while maintaining AAOIFI Shariah compliance.

Its top 5 holdings represent 9.88% of the portfolio, ensuring strong diversification while maintaining AAOIFI compliance. Some investors follow SPSK for globally diversified Sukuk exposure through U.S. markets.

8. Aditum Investment Funds – Aditum Global Sukuk Fund B USD Dis

- Managed by: Aditum Investment Funds

- Fund size (USD): 148.20M GBP ≈ $199.58M USD (As of Aug 31, 2025)

- Expense Ratio / Ongoing Charge: 0.47%

- 2024 Return: -3.60%

- YTD Performance: -7.20% (As of Sep 02, 2025)

The Aditum Global Sukuk Fund has a comparatively lower expense ratio than some peers. Its recent performance has been negative, with year-to-date and 1-year returns both showing declines. Some investors use this fund for its lower-cost structure despite recent periods of underperformance.

9. AZ Fund 1 – AZ Islamic – Global Sukuk A-AZ Fund USD Acc

- Managed by: Azimut Group

- Fund size (USD): 51.80M GBP ≈ $69.64M USD (As of Aug 31, 2025)

- Expense Ratio / Ongoing Charge: 2.13%

- 2024 Return: +5.71%

- YTD Performance: -3.19% (As of Sep 02, 2025)

The AZ Islamic Global Sukuk Fund is actively managed by Azimut Group and invests in sovereign and corporate Sukuk across GCC, Asia, and global markets.

Its top 5 holdings represent 16.99% of the portfolio, combining focus with global reach. Its expense ratio is higher than some peers, but it continues to attract investors interested in active management.

10. ADCB SICAV – ADCB Global Sukuk Fund R USD Retail Acc

- Managed by: Abu Dhabi Commercial Bank (ADCB)

- Share class size: 279.56K GBP ≈ $375.80K USD (As of Aug 31, 2025)

- Expense Ratio / Ongoing Charge: 1.90%

- 1-Year Return: +0.40% (As of Aug 29, 2025)

- 2024 Return: +3.99%

- YTD Performance: -2.69% (As of Aug 29, 2025)

The ADCB Global Sukuk Fund is managed by Abu Dhabi Commercial Bank (ADCB) and invests in sovereign and corporate Sukuk. It has shown modest returns while maintaining Shariah compliance.

Its top 5 holdings make up 30.91% of the portfolio, reflecting a higher concentration compared to peers. This provides targeted exposure but comes with increased concentration risk. Some investors use this fund for Sukuk exposure with a focus on capital preservation.

AAOIFI Compliance in Sukuk Investing (2025)

Shariah-compliant Sukuk funds in 2025 are asset-backed, Riba-free, and aligned with AAOIFI standards, ensuring ethical and faith-based investing. Key rules include limiting debt to 30% of market cap, restricting haram income to under 5%, and excluding prohibited activities such as gambling and alcohol. Platforms like Tabadulat provide access to globally certified Sukuk funds and Halal ETFs, offering investors transparency and compliance with Islamic finance principles.

Want to ensure your investments follow Islamic principles? Explore AAOIFI Shariah compliance.

Tabadulat as a Platform for Sukuk Access (2025)

Accessing global Sukuk investments is now simpler than ever. Tabadulat provides:

- All-in-one platform: Sukuk funds, Halal ETFs, and Shariah-compliant equities

- Verified compliance: Daily Shariah screening by qualified scholars

- Investment tools: Portfolio trackers, analytics, and Zakat calculators

- Transparent pricing: Clear, low-cost fee structure

In 2025, investors can access Sukuk funds and Halal ETFs through platforms such as Tabadulat

FAQs

What is the outlook for Sukuk in 2025?

Market reports in 2025 indicate growth expectations in GCC countries, Malaysia, and parts of Europe. Sukuk are becoming a key part of global Islamic finance and are now compared with other asset classes in terms of total return and investment risk. Fund managers are also expanding their investment strategy for Sukuk, including in emerging markets and the United States, to meet growing demand.

What are Sukuk funds?

Sukuk funds are Shariah-compliant fixed-income investments that acquire Sukuk (Islamic bonds). These funds allow investors to access diversification across different types of investments while following AAOIFI standards. They often report their net assets and net asset value (NAV) to investors and can be structured as exchange-traded funds (ETFs) or actively managed funds, depending on the investment strategy and risk profiles chosen by the fund managers.

Are Sukuk suitable for all investors?

Whether Sukuk is suitable depends on an individual’s circumstances, risk tolerance, and goals. Professional financial advice should always be sought before making investment decisions. Sukuk have historically exhibited relatively low default rates compared with some other fixed-income asset classes. However, investors should carefully assess the fund structure, fees, and potential risks, and seek professional financial advice before making any investment decisions.

Are Sukuk halal or haram?

Sukuk are considered halal when they follow AAOIFI guidelines. This means they must be asset-backed, avoid interest and excessive uncertainty, and exclude prohibited industries. Fund managers ensure that these investments meet strict Shariah rules, making them suitable for investors seeking ethical types of investments within global exchange trading markets.

What are the main types of Sukuk?

The main types of Sukuk include:

- Ijara Sukuk (lease-based, where investors receive rental income),

- Mudarabah Sukuk (profit-sharing),

- Murabaha Sukuk (cost-plus sale).**

Each type has different risk profiles and can be part of broader investment strategies that diversify fund assets across emerging markets and other regions. These structures are commonly used by fund managers in both actively managed funds and exchange-traded funds (ETFs).

What is the difference between bonds and sukuks?

A bond is a debt instrument where the issuer pays interest to the bondholder. In contrast, a Sukuk is a Shariah-compliant certificate that represents a share of ownership in an underlying asset, with investors receiving a portion of the asset's profit or rental income.

Disclaimer: This content is for informational purposes only and does not constitute investment advice, financial guidance, or an offer to buy or sell any securities. Performance figures are based on publicly available data as of July–September 2025 and may change. Investors should consult qualified financial advisors before making investment decisions.