REITs & Halal Real Estate for Muslim Investors

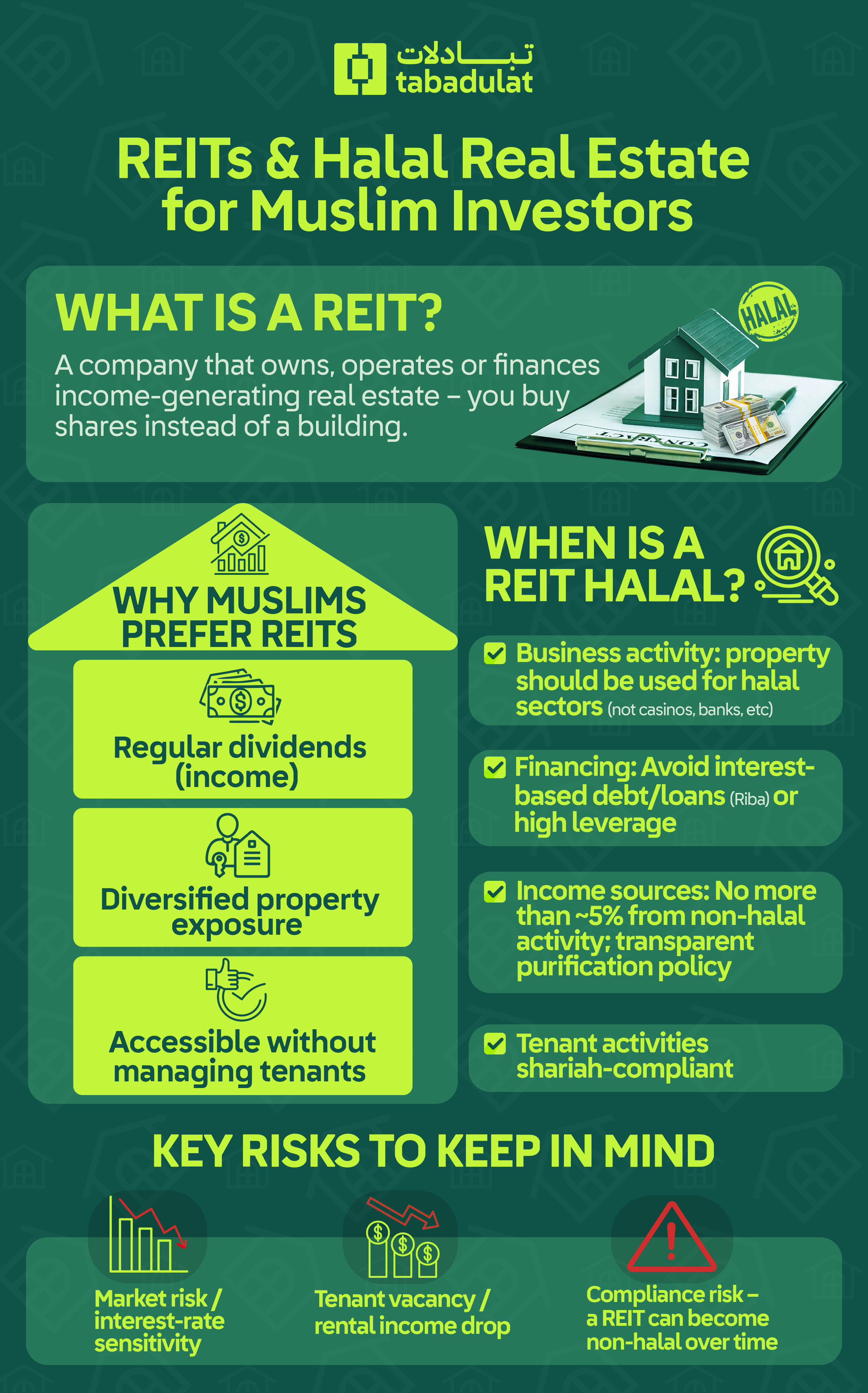

Can you invest in real estate without owning property and stay Halal? This guide explores what REITs are, how they work, and what makes them Shariah-compliant. Learn how to screen REITs with Tabadulat.

When most people think about Halal investing in real estate, they imagine buying an apartment, renting it out or flipping properties. But that’s not practical for some Muslim investors. There’s another way to access the property market, without the stress of managing tenants, dealing with maintenance or needing a large upfront capital whilst adhering to Islamic finance principles.

Real Estate Investment Trusts (or REITs) are fast becoming a popular Halal Investment for Muslim investors to get exposure to property markets around the world.

But the big question for Muslim investors is: Are REITs Halal? And if so, how do you choose one that fits your faith and financial goals?

Let’s break it down.

What is a REIT?

A REIT is a company that owns, operates or finances income-generating real estate. Think shopping malls, office towers, warehouses, hotels or even apartment blocks.

Rather than buying a physical building, you’re buying shares in a REIT, which then pays you regular dividends from the rental income it earns. It’s like owning a slice of a big real estate portfolio.

REITs are listed on stock exchanges just like companies. This means they’re usually liquid (easy to buy and sell), transparent (subject to regulations), and accessible for a small amount.

Other alternatives to REITs are ETFs, which is a basket of securities, like stocks, commodities or bonds, that is listed and traded on a major exchange. For a breakdown on ETFs, see our guide.

Why Are REITs Popular?

REITs are designed to offer stable and long-term income. Most are legally required to distribute at least 90% of their taxable income to shareholders. This makes them attractive for investors looking for steady cash flow, especially during market volatility.

Key advantages of REITs include:

- Regular dividends-These are often higher than what you’d earn from traditional stocks or bonds.

- Diversification-This offers exposure to multiple properties and sectors, reducing your risk.

- Accessibility-You can invest with as little as a few hundred dollars

- Professional management-There is no need to manage properties yourself, reducing hassle and stress.

Are all REITs Halal?

The short answer: some are, some aren’t.

Like Halal stocks and ETFs, REITs must be screened for Shariah compliance.

For a breakdown on Halal Stock Screening, see our guide.

Here are the main factors to consider when looking for Shariah compliance in REITs:

1. Business Activity

The REIT must earn income primarily from Halal activities. That means REITs involved in casinos, conventional banks, breweries, or adult entertainment venues would be non-compliant.

A Shariah-compliant REIT typically focuses on residential, industrial, logistics or healthcare properties, not Haram sectors.

2. Financial Ratios

Shariah standards from international bodies like the Accounting and Auditing of Islamic Financial Institutions (AAOIFI) set financial ratios that companies must meet in order to be considered Halal.

A key consideration is the level of interest-bearing debt. If a REIT carries too much conventional debt or earns excessive debt from cash or Ribawai bonds, it may be non-compliant.

Under AAOIFI standards, companies should not have:

- Interest-bearing debt of more than 30% of market capitalisation

- Interesting-taking deposits of more than 30% of market capitalisation

- Haram income of total income of more than 5%

For a full breakdown on AAOIFI standards, see our blog.

3. Rental Structure

In Halal REITs, lease contracts should not include Riba-bearing penalties and the rental income must come from tenants engaged in Halal business activities.

Some scholars also look into whether the REIT uses Ijara (lease-based) structures for compliance.

Are There Any Islamic REITs?

Yes! And the list is growing more.

Several Muslim countries like the UAE, Saudi Arabia and Malaysia have led the way in launching Islamic REITs. These are dedicated REITs that have been structured in a way that complies with Shariah principles.

Examples of Islamic REITs include:

- Emirates REIT (UAE)-Invests in office, retail, and education-related properties.

- Jadwa REIT Saudi Fund-(Saudi Arabia) Invests in commercial and hospitality properties

- Bonyan REIT (Saudi Arabia)-Offers exposure to a portfolio of Halal income-generating real estate.

- Al-Aqar Healthcare REIT (Malaysia)-Focuses on healthcare-related real estate opportunities.

These REITs are overseen by Shariah supervisory boards which often provide annual fatwas to certify their compliance.

Some Halal global equity funds also screen REITs listed in the US, UK and other geographies to identify those that meet Shariah thresholds.

How Have REITs Performed?

Indeed, REITs can be affected by interest rates, economic cycles as well as real estate trends.

On the whole, over the past five years, performance has varied across regions and sectors:

- US REITs: Delivered solid long-term returns, though 2022 saw a dip due to interest rate hikes. Residential and data centre REITs have rebounded strongly.

- GCC REITs: Generally stable, with many offering yields 5–8% dividend. Islamic REITs in the GCC tend to focus on income more than capital growth.

- Global Trends: Logistics, healthcare, and data centre REITs have outperformed retail and office segments, especially post-COVID.

As always, past performance isn’t a guarantee for current or future performance, but REITs can be part of a diversified Halal portfolio, depending on an investor's goals and risk appetite.

What Are the Risks?

Like any investment, REITs come with risks. These include:

- Market risk-REIT prices can drop due to economic downturns or rising interest rates.

- Liquidity risk-Some REITs (depending on the geography and market) can be illiquid, making harder for investors to trade/sell.

- Tenant risk-If tenants’ default or leave, rental income may fall.

- Compliance challenges- A previously Halal REIT could become non-compliant over time.

How Tabadulat Can Help You Access REITs

You can invest in Shariah-compliant REITs directly by buying shares on a stock exchange or indirectly via Halal funds and Halal investment platforms like Tabadulat (coming soon).

At Tabadulat, we will screen over 40,000 global stocks and ETFs every day, including REITs. We will follow AAOIFI standards. So if a REIT passes or fails screening, we’ll flag it as Halal or not on your dashboard.

We will also monitor for ongoing compliance. If a REIT’s debt level rises or it starts leasing to non-Halal businesses, you’ll be alerted. And if purification (cleansing of non-halal income) is required, we’ll tell you how much.

We believe no Muslim investor should have to guess whether their portfolio is Halal. That’s why we provide a comprehensive Shariah breakdown of their portfolio and prospective investments to every user at no extra cost.

We’re here to provide you with a seamless Halal investing journey, from start to finish.