Smart Halal Investing: Mutual Funds to Watch in 2026

Explore Halal mutual funds to watch in 2026. Learn how Shariah-compliant mutual funds work, compare historical performance, AUM, fees, and governance frameworks, and understand how ethical investing aligns with long-term financial goals.

Halal Mutual Funds in 2026: The Rise of Shariah-Compliant Mutual Funds

The launch of the first Islamic mutual fund in September 1990 marked a key milestone in the development of modern Islamic finance. At that time, Halal investing was primarily focused on basic equity screening to ensure compliance with Shariah principles. Over the following decades, the market evolved significantly, expanding beyond equities to include Sukuk funds, ESG-aligned strategies, and diversified multi-asset portfolios. By 2026, Halal mutual funds have become a mature and globally diversified segment within the broader landscape of ethical and responsible investing.

In this context, more people than ever are asking a simple yet important question: How can I grow my money ethically without compromising my values? Rising awareness of ethical investing and Islamic finance has led many investors to explore Shariah-compliant options such as Sukuk, Halal ETFs, and Halal mutual funds. These funds provide access to global markets while adhering to clearly defined Shariah guidelines.

Halal mutual funds exclude industries such as alcohol, gambling, conventional banking, tobacco, and weapons, yet they still offer exposure to high-growth sectors across international markets. Unlike direct stock selection, these funds provide professionally managed portfolios supported by Shariah screening, financial ratio filters, and ongoing governance oversight.

However, Halal and Shariah-compliant mutual funds are not homogeneous. They differ in performance, assets under management (AUM), fee structures, geographic focus, and sector allocation, which directly affects Shariah-compliant funds' performance over time.

Understanding these differences is therefore essential for investors seeking to align ethical considerations with long-term financial objectives.

What is a Halal Mutual Fund? Understanding Shariah-Compliant Investing

A Halal mutual fund, also known as a Shariah-compliant mutual fund or Islamic mutual fund, is a professionally managed investment vehicle that aims to align with Shariah principles, guided by AAOIFI standards as interpreted and applied by the fund’s appointed Shariah advisory board.

Its main goal is to allow investors to access markets without investing in prohibited activities.

Halal mutual funds apply two main layers of screening:

- Sector Screening: Excludes alcohol, gambling, conventional banking, tobacco, weapons, and pork-related businesses.

- Financial Screening: Limits excessive debt and interest-based income to remain Shariah-compliant.

These funds are supervised by independent Shariah advisory boards, which review holdings based on their scholarly interpretation of Shariah principles. Compliance is subject to ongoing monitoring and may be subject to change over time.

In practice, Halal mutual funds allow investors to:

- Access local and global equity markets

- Benefit from professional fund management

- Invest within a clear Shariah-compliant framework

While all Halal mutual funds follow Islamic principles, they differ in performance, size, fees, sector focus, and geography. Comparing them is crucial for informed investment decisions.

For more on Halal investing principles, see: What is Halal Investing, Islamic Finance and Halal Stocks?

Important note on Shariah compliance: Shariah compliance referenced in this article is based on each fund’s publicly disclosed screening methodologies and the oversight of its appointed Shariah advisory board. Interpretations may differ across scholars and jurisdictions, and compliance status may change over time due to portfolio adjustments or revised assessments.

Why Investors Choose Islamic Mutual Funds

Halal mutual funds are preferred by those seeking a structured, ethical way to invest in financial markets. They are often considered a form of socially responsible investing (SRI), as they combine ethical screening, financial discipline, and governance oversight. While rooted in Islamic finance principles, these funds also appeal to non-Muslim investors seeking value-based and ethical investment strategies.

Key Features:

- Professional management: Shariah screening applied by fund managers.

- Shariah governance: Advisory boards review holdings and purify non-compliant income.

- Sector focus: Many funds emphasize Technology, Healthcare, Industrials, Consumer Services, and Financial Services.

- Transparency: Most publish regular updates on performance, holdings, fees, and compliance.

For educational and research purposes, investors may refer to publicly available platforms such as Tabadulat, Morningstar Islamic Indexes, and other Islamic finance resources to review fund disclosures, methodologies, and historical data. Mention of these platforms does not imply endorsement or recommendation. Investors may also use dedicated Shariah screening tools to assess mutual funds using AAOIFI-based financial ratios, sector exclusions, and ongoing compliance checks.

For more about Shariah-compliant ETFs, see: Are ETFs Halal? A Guide to Shariah-Compliant Investing.

10 Halal Mutual Funds in 2026: Performance, AUM, and Shariah Compliance

Before diving into the table, here’s a simple overview of 10 Halal mutual funds. Each fund is reported as Shariah-compliant based on publicly disclosed screening criteria and Shariah advisory oversight, offering exposure to various markets.

Key Highlights Before the Table:

- Performance (5-Year Absolute Return): Shows historical growth trends.

- Fund Size (AUM): Indicates the scale and liquidity of the fund.

- Expense Ratio: Annual management costs.

- Geographic Focus: Main market exposure (Global, U.S., India, Asia-Pacific).

- Sector Focus: Top industries emphasized by Shariah screening.

- Shariah Governance: Presence of advisory boards and compliance oversight.

10 Halal Mutual Funds for your portfolio in 2026:

- Templeton Shariah Global Equity Fund AS (acc) SGD

- abrdn Islamic World Equity Fund

- Tata Ethical Fund

- Nippon India Nifty Next 50 Junior BeES

- Taurus Ethical Fund

- Amana Growth Fund (AMAGX)

- Iman Fund (IMANX)

- Saturna Sustainable Equity Fund

- Manulife Shariah Asia-Pacific Fund

- Franklin Shariah Global Multi-Asset Income Fund

Shariah-Compliant Funds Performance Snapshot (2025–2026)

The table below provides a side-by-side snapshot of 10 Shariah-compliant mutual funds, focusing on region and 5-year absolute return to help investors assess Shariah-compliant funds' performance in 2026.

Disclaimer: All performance figures presented below are historical, based on publicly available fund disclosures, and reported as of the dates specified. Historical returns do not predict future performance.

Table 1: Halal Mutual Funds – 5-Year Performance Snapshot (2025–2026)

Sources: Each fund’s website and FT

Note: All figures presented are historical, based on publicly available fund reports as of November–December 2025 (unless otherwise stated). These figures are provided for informational purposes only and should not be interpreted as investment recommendations or guarantees of future performance.

Let’s dive in and explore each Halal mutual fund in detail!

Note that: This overview is provided for informational purposes only and does not constitute investment advice.

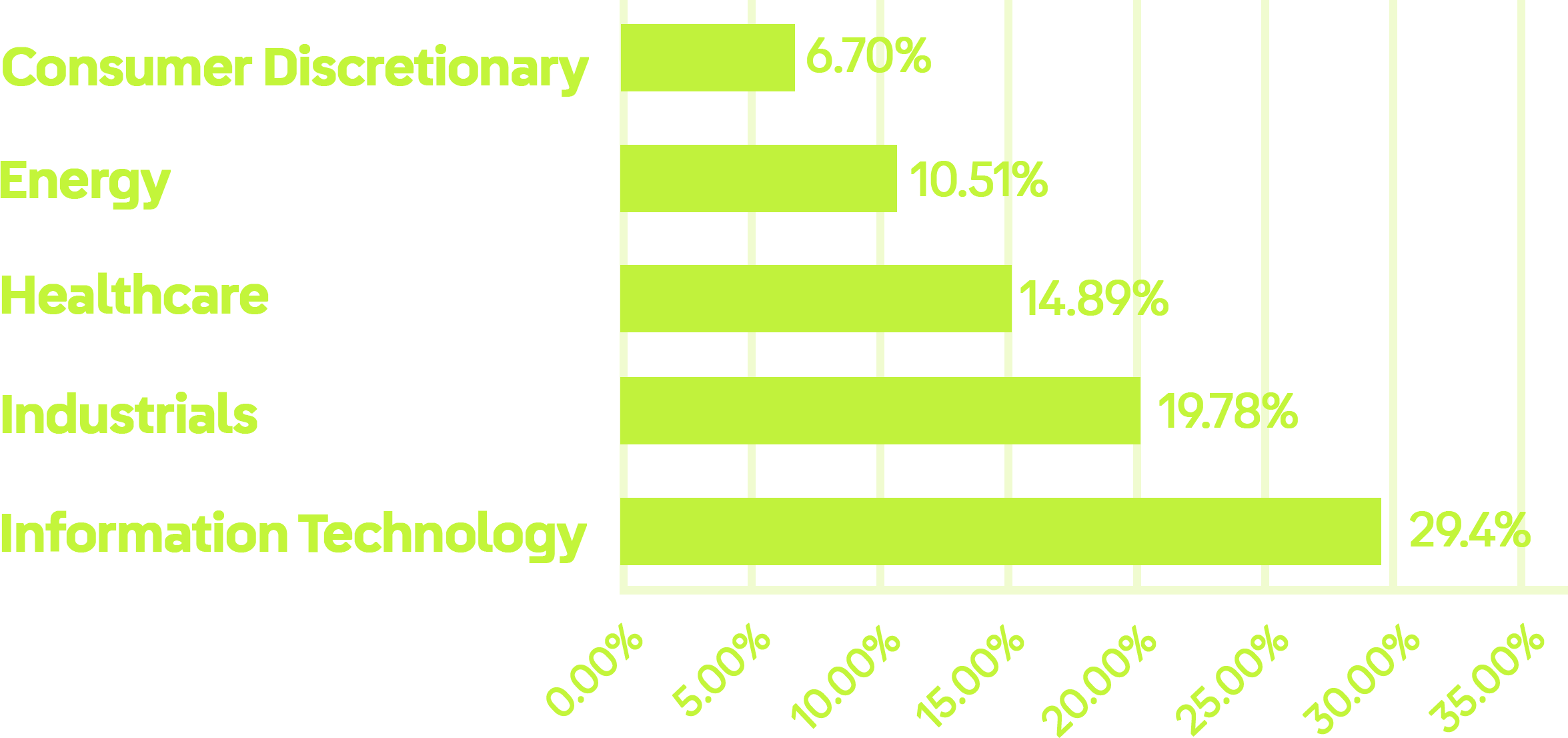

Templeton Shariah Global Equity Fund AS (acc) SGD – Global

- AUM (Nov 30, 2025): $152.38M

- Net Expense Ratio: 1.90%

- 5-Year Absolute Return: +46.57%

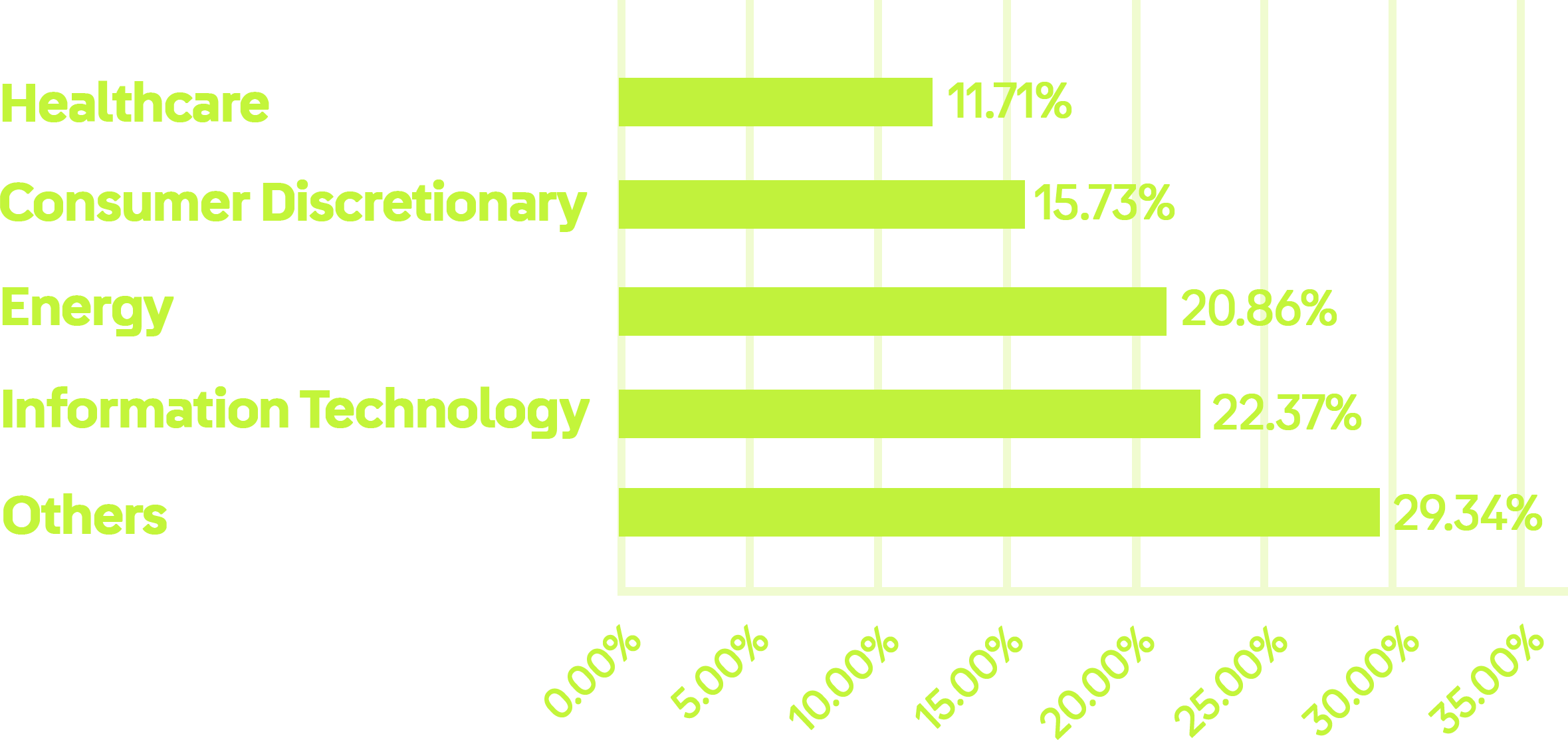

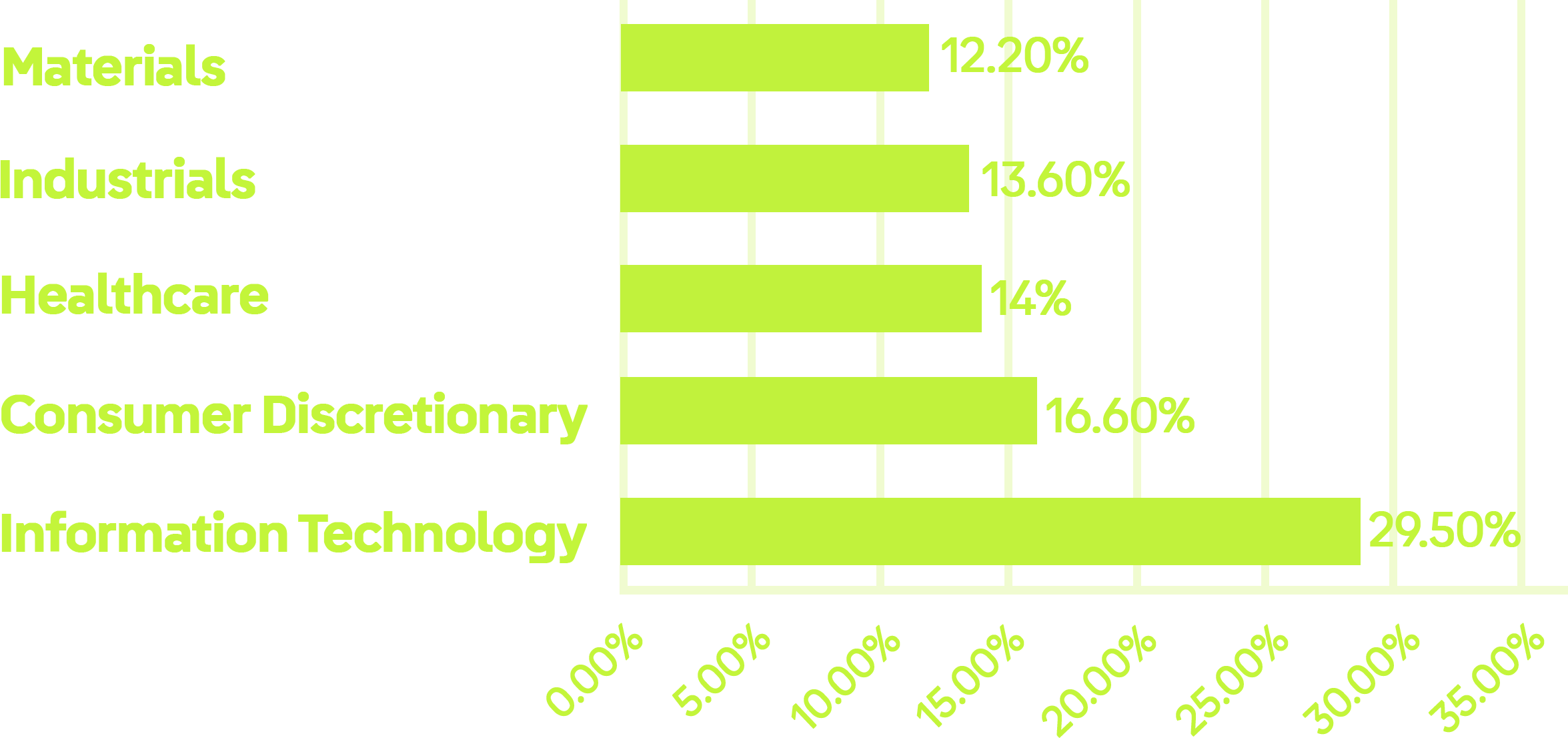

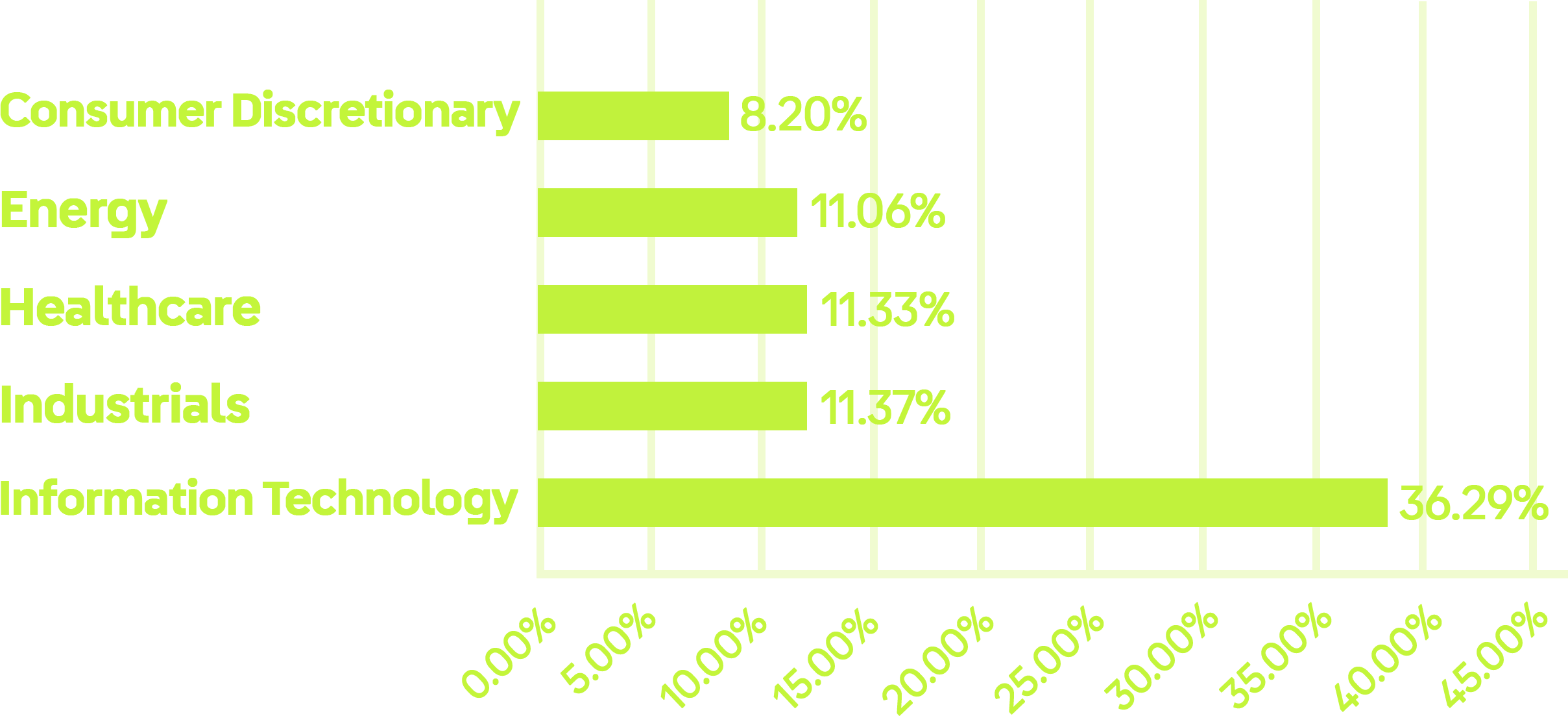

- Top 5 Sectors: Information Technology, Industrials, Healthcare, Energy, Consumer Discretionary

Templeton Shariah Global Equity Fund is a professionally managed global equity fund with Shariah-compliant investment principles. The fund applies sector and financial ratio screening to exclude prohibited industries, such as alcohol, conventional banking, gambling, tobacco, and weapons. Oversight is provided by an appointed Shariah advisory board, and compliance is monitored continuously to ensure alignment with Islamic finance standards. The fund seeks diversified exposure to international equities while maintaining ethical and Shariah-compliant practices.

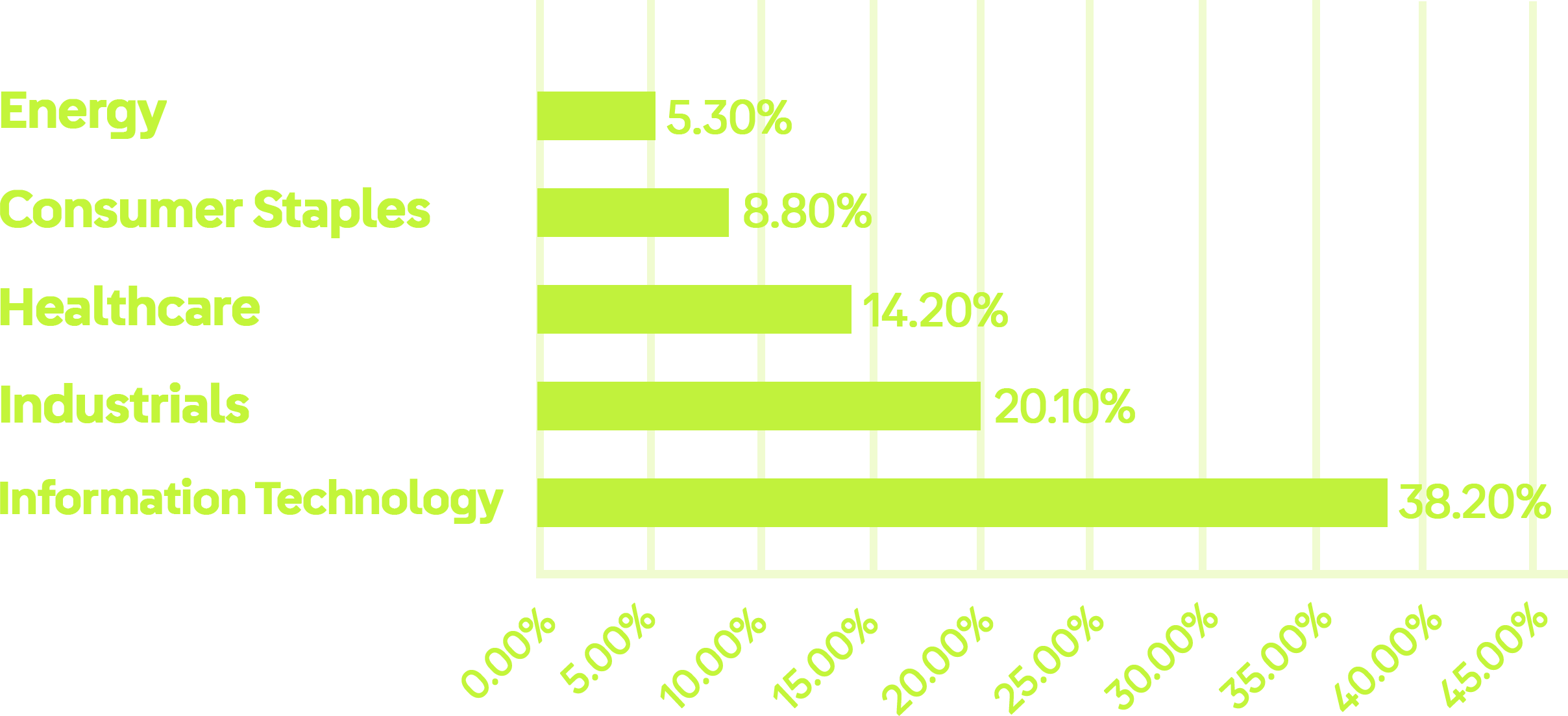

abrdn Islamic World Equity Fund – Global

- AUM (Oct 31, 2025): $944.83M

- Net Expense Ratio: Not publicly available

- 5-Year Absolute Return: +30.90%

- Top 5 Sectors: Information Technology, Industrials, Healthcare, Consumer Staples, Energy

abrdn Islamic World Equity Fund is a Shariah-compliant global equity fund designed to provide diversified international market exposure. The fund implements sector exclusions and financial ratio filters in accordance with its disclosed compliance methodology. The appointed Shariah advisory board supervises adherence to Shariah principles, ensuring ongoing monitoring and review to maintain ethical investment practices.

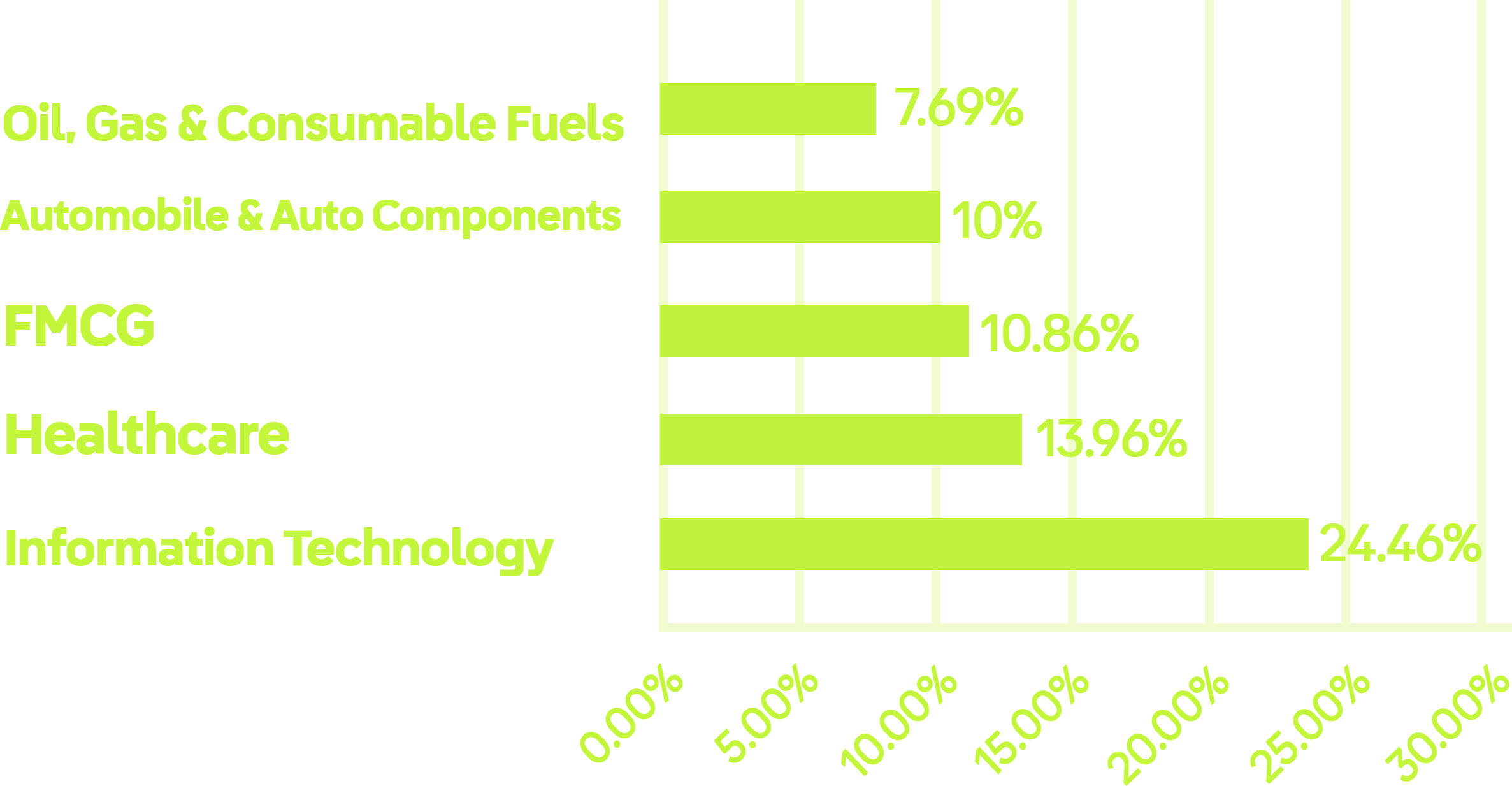

Tata Ethical Fund – India

- AUM (Dec 14, 2025): ₹3,797.19 Cr (~$417.29M)

- Net Expense Ratio: 0.65%

- 5-Year Absolute Return: +16.92%

- Top 5 Sectors: Information Technology, Healthcare, FMCG, Automobile & Auto Components, Oil, Gas & Consumable Fuels

Tata Ethical Fund is an Indian equity fund that adheres to Shariah-compliant investment criteria, including sector and financial ratio screening. The fund targets large-cap Indian companies while excluding non-compliant industries. A Shariah advisory board oversees portfolio composition, with periodic reviews to ensure continuous alignment with Islamic investment standards.

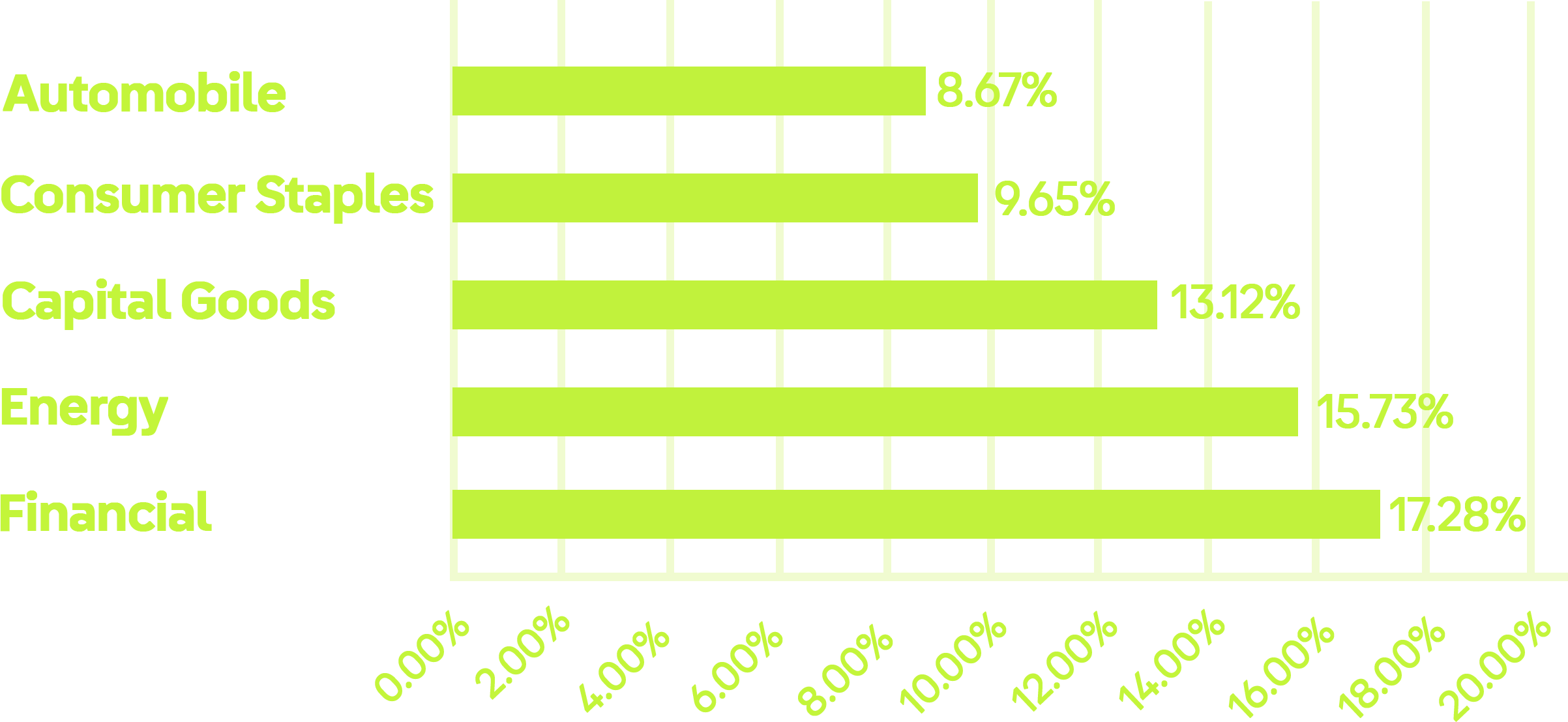

Nippon India Nifty Next 50 Junior BeES – India

- AUM (Dec 15, 2025): ₹656.88 Cr (~$72.19M)

- Net Expense Ratio: 0.29%

- 5-Year Absolute Return: +16.82%

Top 5 Sectors: Financial, Energy, Capital Goods, Consumer Staples, Automobile

This passive fund tracks a Shariah-screened version of the Nifty Next 50 Index. Compliance is based on the index provider’s screening methodology and Shariah principles, with rebalancing conducted periodically. The fund offers exposure to Indian equities while maintaining alignment with Shariah-compliant standards.

Taurus Ethical Fund – India

- AUM (Dec 15, 2025): ₹365.51 Cr (~$40.17M)

- Net Expense Ratio: 2.38%

- 5-Year Absolute Return: +14.78%

- Top 5 Sectors: Others, Information Technology, Energy, Consumer Discretionary, Healthcare

Taurus Ethical Fund is a multi-cap Indian equity fund managed according to a Shariah-compliant screening methodology. The fund’s Shariah advisory board supervises compliance with sector exclusions and financial ratio rules. Portfolio adjustments are made periodically to maintain ethical and Shariah-aligned investments.

Amana Growth Fund (AMAGX) – USA

- AUM (Nov 30, 2025): $6.05B

- Net Expense Ratio: 0.86%

- 5-Year Absolute Return: +14.29%

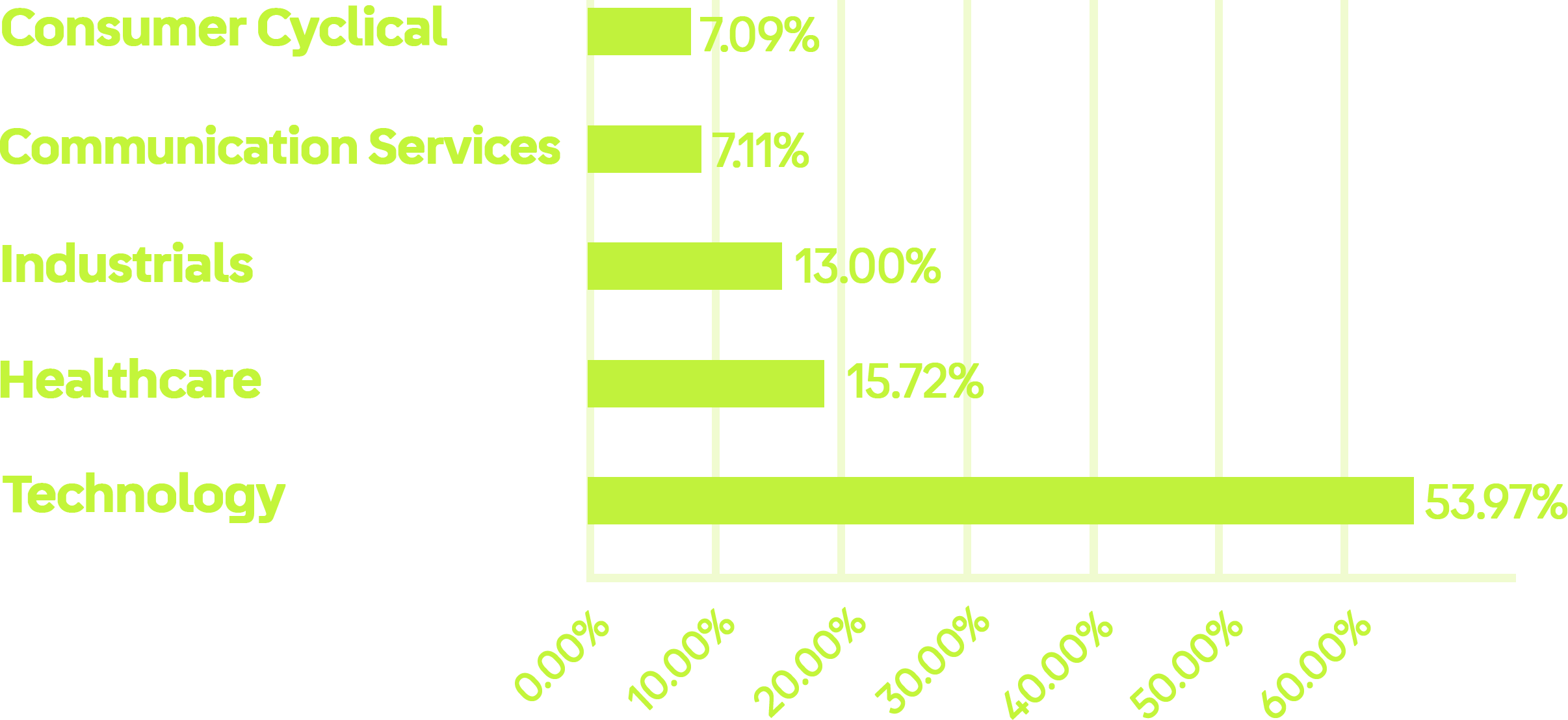

- Top 5 Sectors: Technology, Healthcare, Industrials, Communication Services, Consumer Cyclical

Amana Growth Fund is a U.S. equity fund that applies a Shariah-compliant investment framework under the guidance of its advisory board. The fund focuses on growth-oriented companies while excluding prohibited sectors, and compliance is continuously monitored and reviewed for ethical adherence.

Iman Fund (IMANX) – USA

- AUM (Nov 30, 2025): $228.24M

- Net Expense Ratio: 1.00%

- 5-Year Absolute Return: +9.71%

- Top 5 Sectors: Technology, Healthcare, Communication Services, Industrials, Energy

Iman Fund is a Shariah-compliant U.S. equity fund that applies sector and financial ratio screenings under the supervision of its advisory board. The fund emphasizes selected sectors in line with Shariah principles, with ongoing monitoring to maintain compliance.

Saturna Sustainable Equity Fund – Global

- AUM (Nov 30, 2025): $25.66M

- Net Expense Ratio: 0.75%

- 5-Year Absolute Return: +7.23%

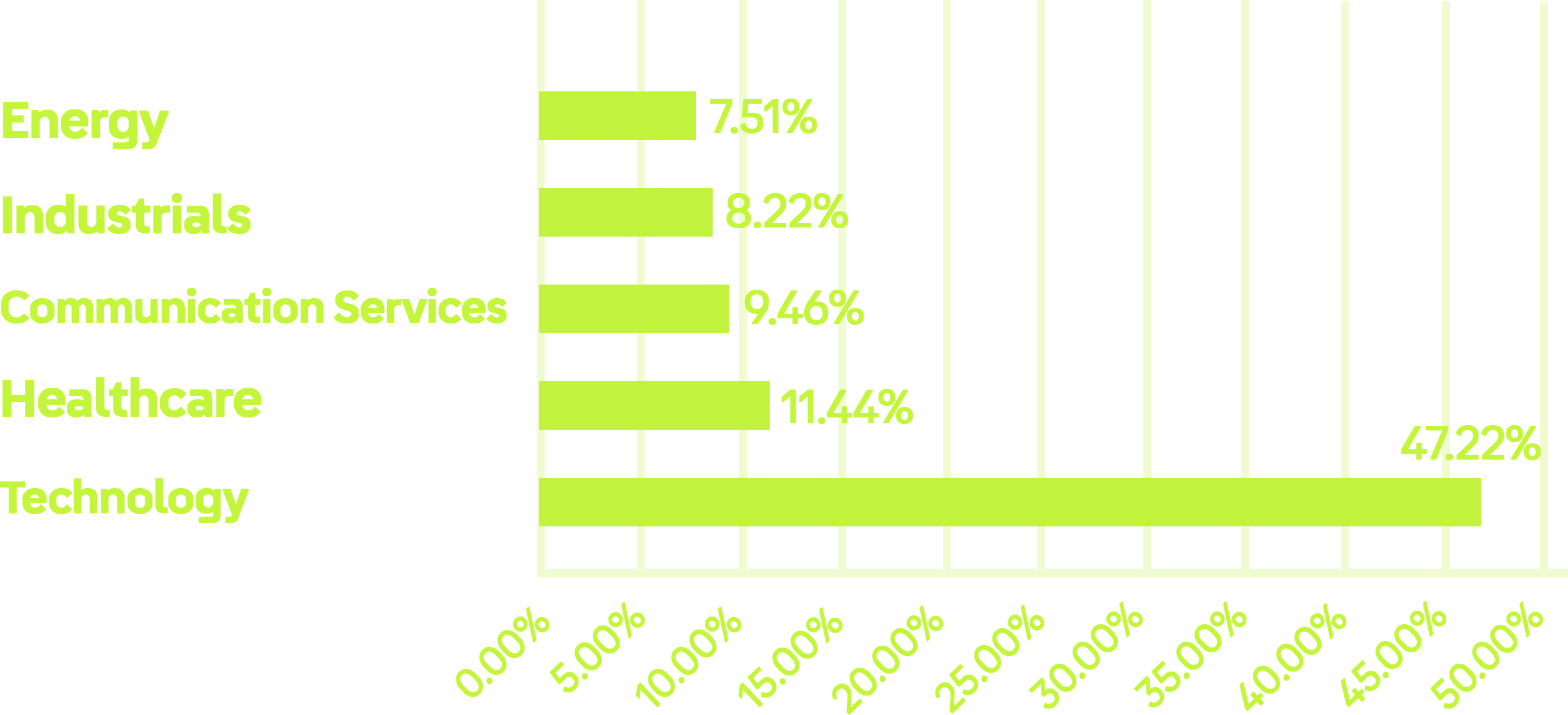

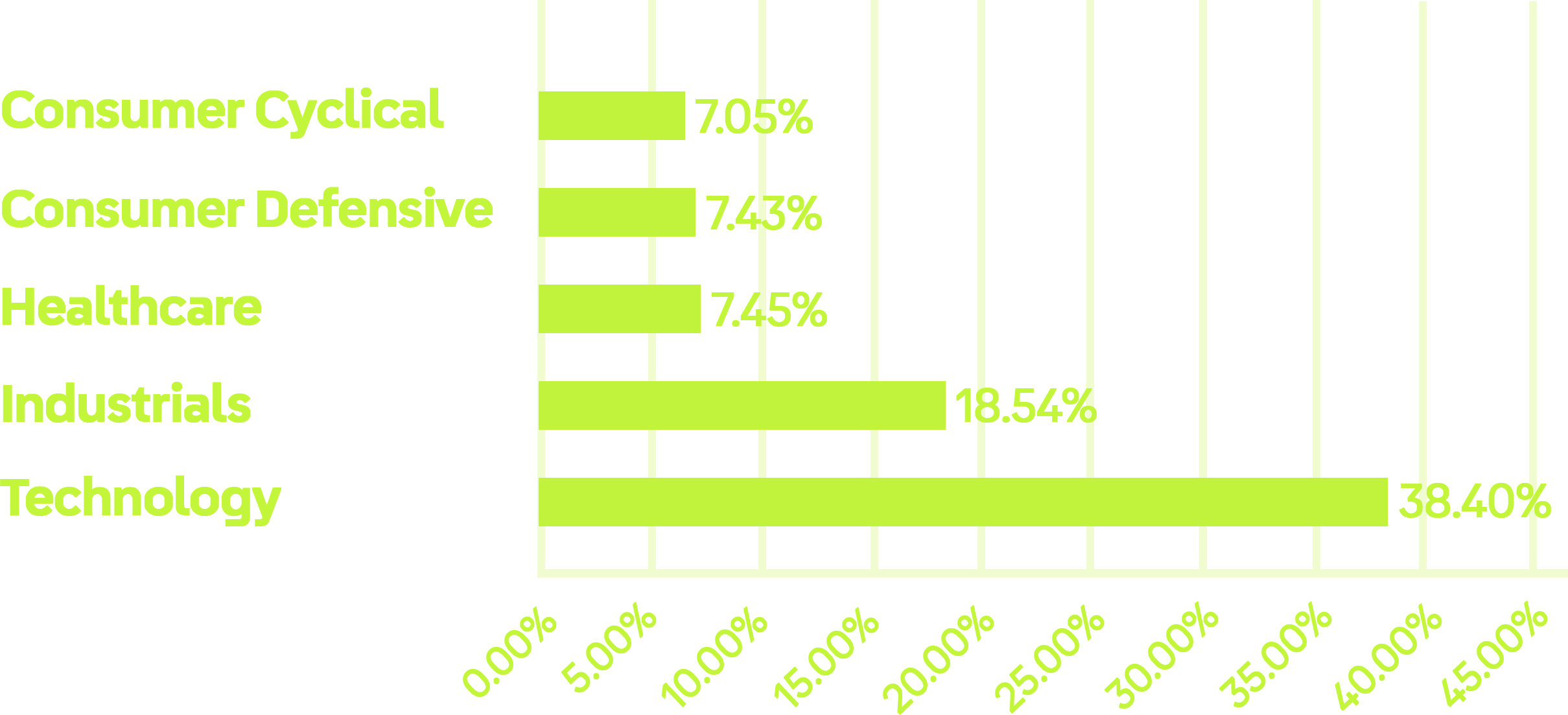

- Top 5 Sectors: Technology, Industrials, Healthcare, Consumer Defensive, Consumer Cyclical

Description: Saturna Sustainable Equity Fund integrates ESG principles with Shariah-compliant investment criteria. The fund’s Shariah advisory board ensures that holdings meet ethical, sustainable, and Shariah standards, with continuous monitoring and adjustments as necessary.

Manulife Shariah Asia-Pacific Fund – Asia

- AUM (Nov 30, 2025): $15.04M

- Net Expense Ratio: Not available

- 5-Year Absolute Return: Data not available

- Top 5 Sectors: Information Technology, Consumer Discretionary, Healthcare, Industrials, Materials.

This Asia-Pacific equity fund (excluding Japan) follows a Shariah-compliant investment framework, applying sector exclusions and financial ratio filters. Compliance is overseen by the fund’s Shariah advisory board and reviewed periodically to ensure alignment with Islamic investment standards.

Franklin Shariah Global Multi-Asset Income Fund – Global

- AUM (Nov 30, 2025): $33.88M

- Net Expense Ratio: 1.75%

- 5-Year Absolute Return: Data not available

- Top 5 Sectors: Information Technology, Industrials, Healthcare, Energy, Consumer Discretionary

Franklin Shariah Global Multi-Asset Income Fund combines equities and Sukuk under a disclosed Shariah-compliant framework. The advisory board monitors adherence to sector exclusions and financial ratio limits, ensuring ongoing compliance and ethical investment oversight.

After exploring each Halal mutual fund, it’s clear that these funds vary widely in size, sector focus, geographic exposure, and historical performance. Each fund represents a distinct approach to Shariah-compliant investing, offering various ways to access global equity markets ethically.

Investor Due Diligence Checklist: Evaluating Halal Mutual Funds (2026) Infographic

Conclusion: Are Halal Mutual Funds Safe and Sustainable in 2026?

Halal mutual funds illustrate how ethical investing frameworks can coexist with long-term growth strategies, though outcomes vary by fund structure, market conditions, and governance practices. As this overview shows, Shariah-compliant funds in 2026 offer diverse exposure across global, US, Indian, and Asia-Pacific markets, with varying approaches to sector allocation, risk, and performance. Differences in AUM, fees, and historical returns highlight why comparing funds is essential before making any investment decision.

Rather than focusing on short-term performance alone, successful Halal investing is about understanding structure, transparency, and ongoing Shariah governance. Funds that clearly disclose their screening criteria and Shariah governance processes help investors understand how compliance is assessed and monitored over time.

As the Halal investing landscape continues to expand, staying informed becomes a key part of ethical wealth building. By tracking performance data, reviewing Shariah compliance updates, and using trusted platforms like Tabadulat, investors can make well-informed decisions that align with both their financial goals and their values in 2026 and beyond.

FAQs

Are halal mutual funds safe in 2026?

Halal mutual funds are generally considered safe when they follow regulated structures, transparent Shariah governance, and diversified portfolio strategies.

Are all Islamic mutual funds truly Halal?

No, not all Islamic mutual funds are truly Halal. You should always verify each fund’s screening rules, portfolio composition, Shariah board approvals, and ongoing compliance reports before investing to be confident of its Halal status.

How is Shariah-compliant fund performance evaluated (30% AAOIFI debt rule)?

The performance of Shariah-compliant funds is evaluated using both financial returns and compliance metrics, including debt ratios defined by AAOIFI Shariah Standard No. 21. A company is considered Shariah-compliant if its interest-bearing debt does not exceed 30% of its market capitalization. This ratio aims to limit excessive exposure to interest-based financing within Shariah-compliant funds.

What is purification of non-compliant income and why does it matter?

Purification means donating any income that comes from non-Halal sources (e.g., incidental interest income) to charity so that your investment returns remain spiritually and financially compliant with Islamic principles, which is especially important for long-term ethical investors.

How to check Shariah compliance in mutual funds?

Investors can check Shariah compliance in mutual funds by reviewing quarterly Shariah board reports, screening methodologies, purification disclosures, and portfolio updates on platforms like Tabadulat.

How do investors typically access Halal mutual funds and monitor them ethically?

Investors access Halal mutual funds through trusted brokers, investment platforms, or services like Tabadulat that specialize in Shariah-compliant investing, check fund performance, fees, and regulatory compliance, and regularly monitor holdings for any changes in Shariah status.

What are the best halal mutual funds in 2026?

The best halal mutual funds in 2026 are typically those with consistent performance, transparent Shariah governance, diversified exposure, and reasonable fees.

Are Halal mutual funds only for Muslim investors?

Shariah-compliant mutual funds are open to all investors, regardless of faith. Many non-Muslim investors choose Halal funds due to their emphasis on ethical screening, lower leverage, and avoidance of speculative activities.

This article is provided for educational and informational purposes only and does not constitute financial, investment, or Shariah advice. Investing involves risk, including potential loss of capital. Past performance does not guarantee future results. Readers should conduct independent due diligence and consult qualified financial and Shariah advisors before making investment decisions.