The Great Debate: ETFs or Mutual Funds?

ETFs vs Mutual Funds, what’s the real difference for halal investing? This guide breaks it down for Muslim investors, comparing flexibility, fees, and Shariah compliance. Discover which one suits your portfolio with help from Tabadulat’s halal stock screener.

You've finally made the pivotal decision to start investing, a commendable step towards securing your financial future. You open your investment app, ready to take control. But you see two terms that can be confusing: ETFs and Mutual Funds.

On the surface, they may appear quite similar, both seemingly designed to help you diversify your investments effectively. However, beneath this initial resemblance lies distinct operational differences. What exactly sets them apart? And, more crucially for your personal financial journey, how do you determine which one aligns best with your specific investment goals and preferences?

If these questions resonate with you, rest assured, you're not alone in seeking clarity. In this comprehensive guide, we'll demystify these investment vehicles, presenting the information in straightforward language, free from technical jargon and unnecessary complexities.

Let us delve into the details.

First Things First: What’s the huge Idea Behind Both?

Think of both ETFs and mutual funds as comprehensive investment funds, carefully constructed to simplify your journey into the financial markets. Instead of putting all your money into one stock, like Nvidia or Tesla, these strong funds include many different stocks. They can also hold various bonds and other financial assets.

This structure helps you diversify your portfolio. This means you can spread your

investments across many companies and sectors. Doing this can lower your overall risk.

However, the basic ways these funds are created, bought by investors, and managed are very different. This is where ETFs and mutual funds start to differ in how they operate.

But how are those funds built, bought, and managed? That’s where ETFs and mutual funds go their separate ways.

ETF meaning definition :

ETF stands for Exchange-Traded Fund. That means:

- A fund whose units you can buy and sell on the stock exchange, just like a stock.

- Prices change throughout the day based on market activity.

- Most ETFs are managed passively. They track an index like the S&P 500, a specific strategy, or a Shariah-compliant index.

- They often come with low fees because they don’t require constant active management.

- Many investors ask, "Do ETFs pay dividends?" Yes, they often do. ETFs pass on the income, like dividends and interest, generated by the securities they hold totheir shareholders.

A Quick Analogy?

ETFs are quite similar to purchasing an entire box of chocolates. When you decide to buy an Exchange-Traded Fund, perhaps through platforms like Robinhood or PhillipCapital, you are effectively acquiring this complete box, and within it, you receive a carefully selected mix of various distinct flavors or types of chocolates. This means you don't individually pick out each separate piece of chocolate; instead, with just one single purchase, you immediately gain access to a wide array of flavors, thereby enjoying both considerable variety and crucial diversification across different assets.

Making Informed Choices with ETF Comparison

A vast selection of ETFs exists. To ensure you pick the best fit for your portfolio, ETF comparison is crucial.

An ETF comparison tool or ETF screener lets you compare ETFs side-by-side. You can look at key metrics like expense ratios, historical returns, and volatility. It also shows the specific industries or regions each ETF covers.

Using an ETF comparison tool helps you understand each fund's features. This ETF finder allows you to make informed choices and create a diverse portfolio that fits your investment goals.

How do Mutual Funds make money?

Mutual funds are a bit different:

- You can’t buy or sell them whenever you want. Instead, you place an order, and the transaction happens once per day, after the market closes.

- Many mutual funds have active management, meaning professional managers select and adjust the investments inside.

- This usually leads to higher fees, you’re paying for that human expertise.

The analogy here?

A mutual fund is quite similar to embarking on a guided group tour. You place your trust entirely in the tour guide, who, in this financial analogy, represents the fund manager.

They are the experts responsible for navigating the investment landscape, selecting

specific destinations (investments), and making all the necessary adjustments.

Consequently, you, as the participant, do not directly control the intricate route taken by the tour or dictate the precise timing of arrivals and departures within the investment portfolio.

Exploring Options with a Mutual Fund Screener

Just like ETFs, with thousands of mutual funds available, finding the right one can feel overwhelming. That's where a mutual fund screener comes in.

This online tool helps you filter mutual funds based on what matters to you. You can look at historical performance, expense ratios, risk tolerance, and Shariah compliance.

Using a mutual fund screener helps you quickly narrow your choices. You can find

funds that match your financial goals and values. This saves you a lot of time and effort in your research.

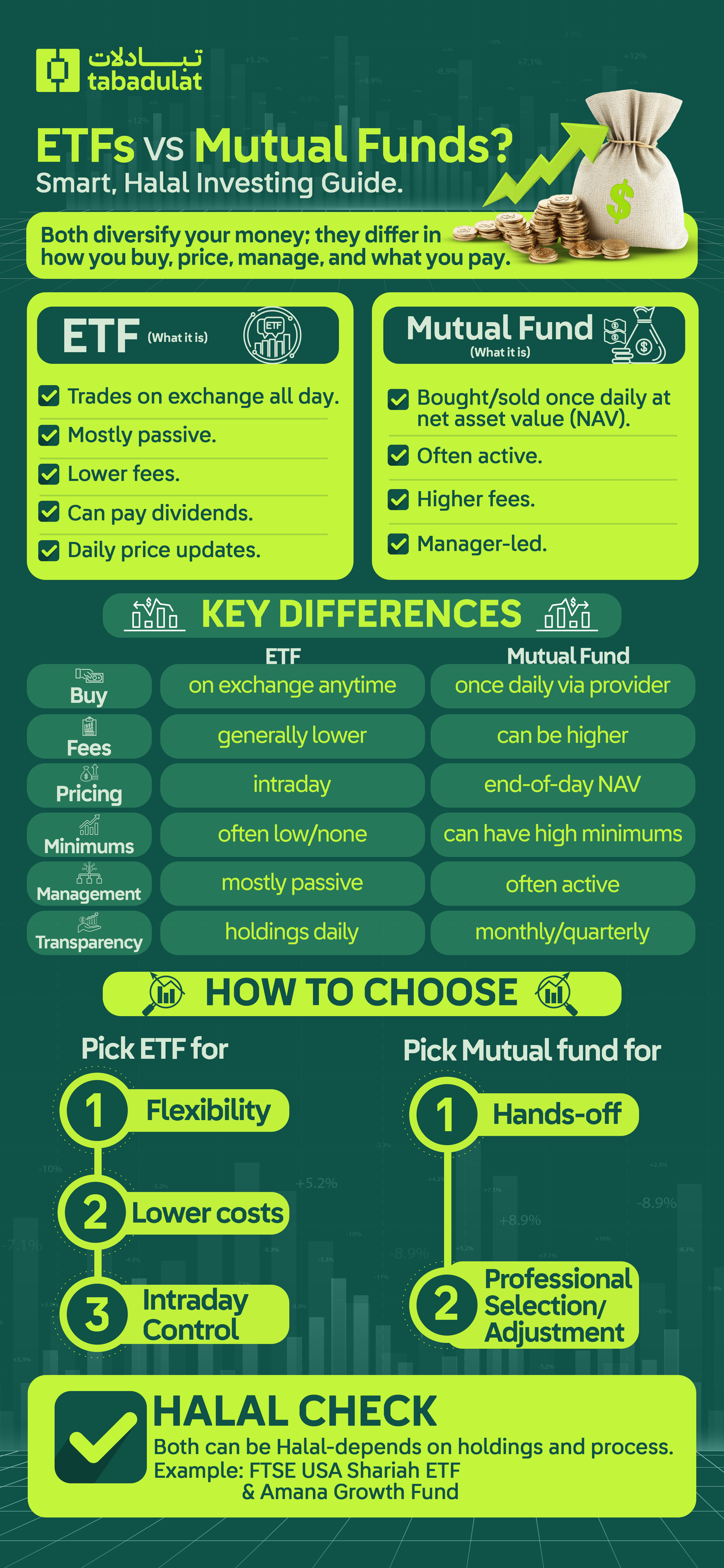

ETF vs. Mutual Fund: The Key Differences

| Feature | ETF | Mutual Fund |

|---|---|---|

| How You Buy | On the stock exchange, anytime | Through a provider, once daily |

| Price Changes | All day, like stocks | End of the day only |

| Management Style | Mostly passive | Often active |

| Fees | Generally low | Can be higher |

| Transparency | Holdings updated daily | Often updated monthly or quarterly |

| Minimum Investment | Often low or none | Sometimes a high minimum |

So… Which One Should You Choose?

There’s no single, universally correct answer for every investor, as the ideal choice largely depends on your personal preferences and financial objectives. However, here’s a straightforward way to approach this decision:

Choose an ETF if you prioritize flexibility in trading, prefer lower expense ratios, and want the ability to actively control the timing of your purchases and sales throughout the trading day.

Opt for a mutual fund if you favor a more hands-off investment strategy. You'll likely be comfortable paying a slightly higher fee in exchange for professional management that handles the selection and ongoing adjustment of investments for you.

Either way, you’re choosing diversification, which is a smart step for any investor, especially beginners, and people who don't want high risk!

But Are ETFs and Mutual Funds Halal in Islam?

Indeed, a significant question.

Yes, both Halal ETFs and Halal mutual funds can exist such as Wahed FTSE USA Shariah ETF and Amana Growth Fund. Whether an ETF or mutual fund is considered halal truly depends on its underlying holdings and its management practices.

At Tabadulat, we take this seriously. We carefully check all investments. options on our platform against stringent Shariah guidelines. This process is overseen by certified scholars, ensuring that when you explore Shariah-compliant mutual funds and other halal investment opportunities with us, you can be confident you're not compromising your values.

So when you browse investment options on our platform, you can trust that you’re not compromising your values.

Summing It Up

Investing doesn't have to be complicated. Once you understand the basics, it becomes easy to see the difference between ETFs and mutual funds. This clear understanding simplifies how you build your diversified portfolio, especially when you also factor in your values and look for halal investment options.

The key takeaway?

ETFs = Offer significant flexibility, come with low costs, and are an excellent choice for investors who prefer a hands-on approach and actively manage their own portfolios.

Mutual Funds = Are more managed and structured, making them a superior option for those seeking professional oversight and a hands-off approach to long-term growth.

Still unsure which option best suits your investment style and financial goals? We

encourage you to explore both ETFs and mutual funds on the Tabadulat platform, allowing your personal values to guide your financial decisions.

FAQs

Are mutual funds Halal?

Yes, some mutual funds are halal. They comply with Islamic law (Shariah) by avoiding prohibited industries and interest. Examples include Amana Growth Fund and HSBC Islamic Funds, which rigorously screen investments for adherence to Islamic values.

Where are mutual funds investing?

Mutual funds pool money from many investors to buy diverse assets. They typically invest in a mix of stocks, bonds, money market instruments, and other securities, tailored to the fund's specific investment objective.

Why are mutual funds going down?

Mutual funds decline when the value of their underlying investments falls due to factors like broader market downturns, economic weakness, rising interest rates impacting bonds, or poor performance of specific sectors they hold.

Are ETFs the same as mutual funds?

No, an ETF is not a mutual fund, though they share similarities. ETFs trade like stocks on an exchange throughout the day. Mutual funds are bought and sold once daily at their end-of-day net asset value (NAV).

Can ETFs be traded throughout the day?

Yes, ETFs trade continuously throughout the day on stock exchanges, just like individual stocks. This offers greater trading flexibility than mutual funds, which typically process orders only once daily after market close.