What Are Sukuk? What Muslim Investors Need To Know...

Sukuk are Shariah-compliant alternatives to conventional bonds, offering Muslim investors a Halal way to earn stable, asset-backed returns. Learn how Sukuk work, their different types, how they compare to interest-based bonds, and how to access them through funds or ETFs — all in one guide.

For many Muslim investors, growing wealth in a Halal way isn’t always straightforward. Stock markets can be unpredictable. Property requires large capital. And conventional savings accounts often involve Riba, which is strictly prohibited in Islamic finance.

In conventional finance, investors typically rely on Riba-bearing bonds to generate predictable income. But what if you want stable returns that are Shariah-compliant?

That’s where Sukuk come in, offering a Shariah-compliant fixed-income solution grounded in Halal investing and real-world assets.

In this blog, we’ll break down Sukuk, the similarities and differences to Ribawi bonds, the different Sukuk structures as well as some of the risks to consider.

How Do Sukuk Work?

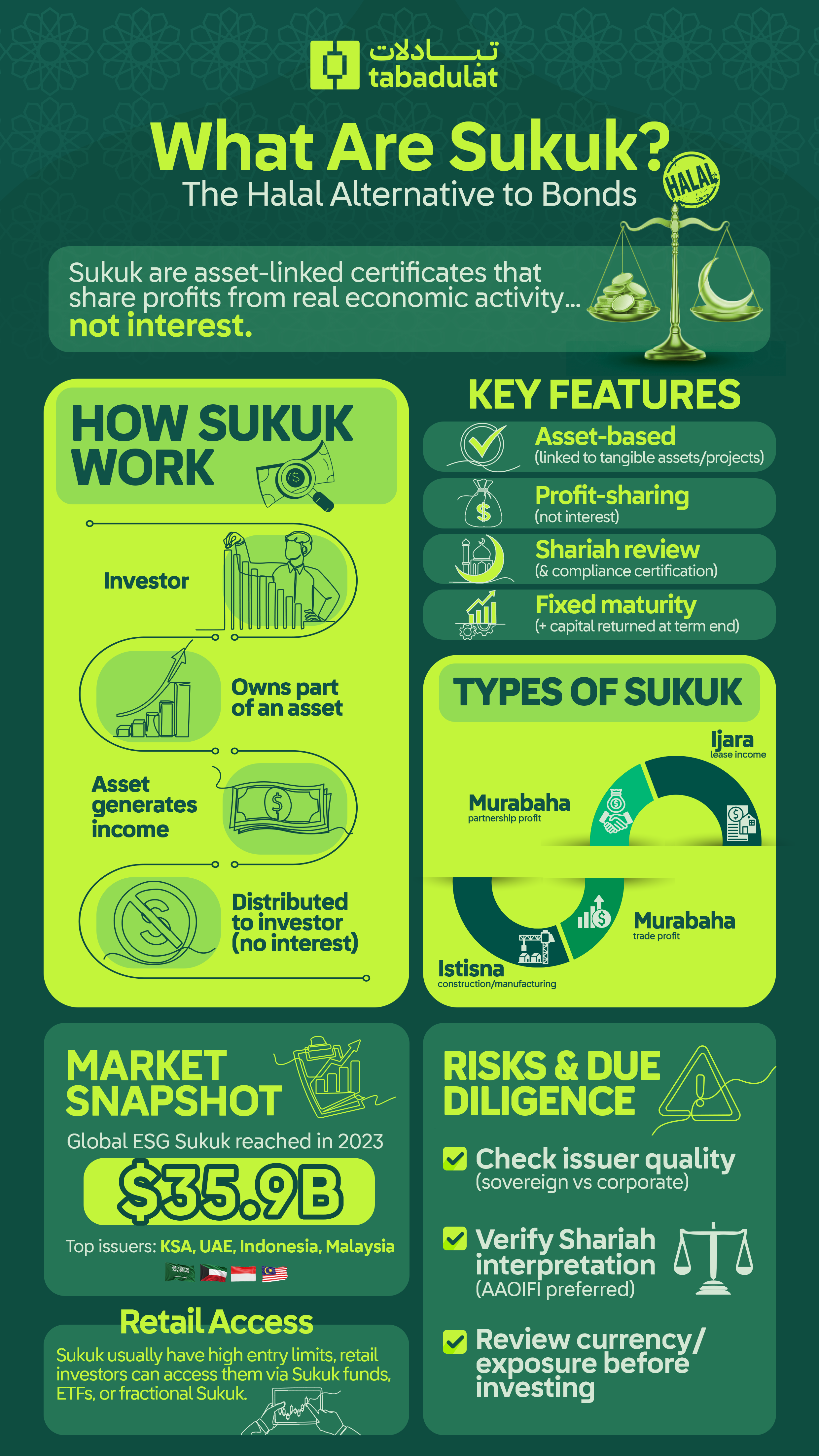

Sukuk (singular, sakk) are financial certificates that represent partial ownership in an asset, project, business, or investment activity.

Sukuk are one of the fastest-growing segments in Islamic finance. Often called ‘Islamic bonds’ due to their similarities with conventional fixed-income products, they offer Muslim investors a Halal way to earn regular returns.

Unlike conventional bonds, which are debt-based and pay fixed (or floating) Riba, Sukuk are based on tangible assets and real economic activities. When you invest in Sukuk, you’re not lending money, you’re buying a share into a real activity that is Shariah-compliant.

For example, Sukuk might fund the construction of a hospital, a toll road or an airline fleet.

Sukuk investors earn returns from the profits generated by the underlying asset or investment, not from interest payments.

Key Features of Sukuk

Here’s what makes Sukuk unique compared to Ribawi bonds:

- Asset-Backed or Asset-Based: Sukuk are linked to tangible assets or halal businesses. This is a fundamental Shariah requirement.

- Profit-Sharing: Instead of earning Riba, Sukuk holders receive returns from the asset’s profit or income generated from the underlying asset or business.

- Shariah Compliance: Every Sukuk is reviewed by a board of Islamic scholars to ensure it meets ethical and religious guidelines.

- Fixed Maturity: Like Ribawi bonds, most Sukuk have a set term, after which your principal is returned.

Sukuk vs Conventional Bonds

Types of Sukuk

There are different types of Sukuk based on different Islamic financing contracts. For retail investors, the key ones to know are:

- Ijara (Lease-based): You earn rental income from leasing an asset, like property or equipment.

- Murabaha (Cost-plus sale): Based on trade finance, profits come from buying and selling goods.

- Mudaraba (Investment partnership): You partner with a business, and profits are shared.

- Istisna (Construction financing): Used to fund manufacturing or construction, with returns tied to delivery milestones.

Each structure has its own risk profile and use case, but all must follow Shariah and Islamic financial principles.

In addition to these structures, Green, Sustainable and ESG-linked Sukuk are increasing. These structures enable Muslim investors to align their ethical, environmental considerations alongside religious values in a single investment.

According to the Islamic Finance Indicator Report 2024, the total value of outstanding ESG Sukuk reached $35.9 billion in 2023.

For a refresher on Halal investing, see our guide

Are Sukuk a Safe Investment?

Like any investment, Sukuk do come with risk. But in general, they’re perceived as lower-risk than equities (stocks), especially when issued by governments or a high-quality issuer.

You’ll still want to consider:

- Who is issuing the Sukuk? Sovereign Sukuk (like those from the UAE, KSA or Indonesia) are usually more stable than corporate Sukuk.

- What are the proceeds being used for? Assets like infrastructure or real estate may be more predictable than speculative projects.

- What currency is it issued in? Some Sukuk are in US dollars, whilst others in local currency, this affects your returns and currency risk.

The good news is that Sukuk often offer predictable income, a key reason why many Muslim investors use them to diversify their Halal portfolio.

It’s also important to understand that different Sukuk jurisdictions adhere to different Shariah interpretations like the Accounting and Auditing of Islamic Financial Institutions (AAOIFI). That means certain Sukuk structures are impermissible in certain jurisdictions.

For a deeper dive into AAOIFI standards, refer to our blog.

How Have Sukuk Performed?

Over the past decade, Sukuk have delivered competitive returns relative to conventional fixed-income investments, while also aligning with Islamic values.

For example:

- The Dow Jones Sukuk Index, which tracks global US dollar-denominated Sukuk, has shown consistent growth since its launch.

- Countries like Saudi Arabia, UAE, Indonesia, and Malaysia have become major issuers, bringing more liquidity and transparency to the market.

Of course, returns can vary by issuer and market conditions. But for investors seeking capital preservation, regular income and Halal-based investing, Sukuk are increasingly attractive.

Can Retail Investors Access Sukuk?

Yes, but access has traditionally been limited.

Many Sukuk are issued in large denominations (most starting at upwards of $200,000) and listed on institutional platforms. But that’s changing.

Because of the high initial denomination of individual sukuk, retail investors usually access sukuk through funds like Franklin Templeton Sukuk Fund or HSBC’s Global Sukuk Fund.

Some issuers are also beginning to offer fractional Sukuk to retail investors. This enables investors to own fractions of Sukuk at a significantly lower cost.

Retail investors can also get Sukuk exposure via Exchange-Traded Funds (ETFs) like the HSBC Global Funds ICAV - Global Sukuk UCITS ETF or SP Funds Dow Jones Global Sukuk ETF.

For an extensive explanation on Halal ETFs, see our guide.

How Can I Invest in Sukuk?

At Tabadulat, Shariah compliance isn’t a feature, it’s our foundation.

We are building the world’s first truly global Shariah-compliant brokerage with one goal in mind: to make Halal investing simple, transparent and accessible for Muslim investors.

We follow AAOIFI standards across everything we do, so every Sukuk and company we will list, every feature we will launch and every policy we will put in place is rooted in Islamic values.

Behind the scenes, our technology screens over 40,000 stocks and ETFs every day to help you make informed Halal choices. Our screening process will backed by leading Islamic scholars and will be overseen by an independent Shariah Supervisory Board, who will review our platform regularly and issue a Fatwa on its compliance.

And we’ve made sure your Halal investing journey is as smooth as possible.

- You will get a full Shariah breakdown of your portfolio, at no extra cost.

- If something becomes non-compliant, we’ll notify you right away so you can take action.

- We even built a Zakat calculator into the platform, so you can purify your wealth and meet your obligations, all in one place.

At Tabadulat, we’re here to support your Halal investing journey every step of the way.

Click Here For 100% Halal, 0% compromise.

FAQs

What is Sukuk in simple words?

Sukuk are Shariah-compliant investments that let you earn profit from real assets or projects. Unlike bonds, they don’t involve Riba and follow Islamic finance principles.

What are three types of Sukuk?

Three common types of Sukuk are: Ijara – based on leasing; investors earn rental income. Murabaha – based on buying and selling goods at a profit and Mudaraba – a partnership where profits are shared between investor and manager.

What is the difference between Sukuk and Takaful?

Sukuk are Halal investment instruments that let you earn profit from real assets or projects. Takaful is Islamic insurance, where members contribute to a shared pool to support each other in times of need. Sukuk grows your wealth, while Takaful protects it.

Is it good to invest in Sukuk?

Sukuk can be a good investment if you're looking for stable, Halal returns. They offer lower risk than stocks, regular income, and align with Islamic finance principles. This makes them a useful option for long-term and Halal investing.

Is Sukuk really Halal?

Yes, Sukuk are designed to be Halal. They avoid Riba, are backed by or are based on real assets, and follow Islamic contracts like Ijara or Murabaha. Each Sukuk is reviewed by Islamic scholars to ensure it meets Shariah standards.

Can Muslims invest in bonds?

Conventional bonds are generally not Halal because they involve Riba, which is prohibited in Islam. Instead, Muslims investors can invest in Sukuk, which are Shariah-compliant alternatives that generate profit through real assets, not interest.

Are Sukuk debt instruments?

While Sukuk share similar characteristics to Ribawi bonds, they are not debt instruments in the conventional sense. Sukuk represent ownership in an underlying asset or project. Sukuk investors earn profit from that asset, not Riba from a loan. This structure makes Sukuk Shariah-compliant.

Is Sukuk debt or equity?

Sukuk are neither pure debt nor pure equity. They are structured to represent ownership in real assets or business ventures, making them closer to asset-based or backed investments. While they can have features similar to debt (like fixed terms and profit payouts), they avoid Riba and follow Islamic finance principles.