What is Halal Investing? Halal Stocks, Halal ETFs & Islamic Finance

Learn how halal investing differs from conventional investing. We outline Islamic finance principles and show how Tabadulat’s free halal stock screener and tools help you invest globally without compromising your values.

Let’s be honest — the world of investing can often feel overwhelming. Complex charts, tickers, jargon, and risk, halal investments can seem intimidating, especially for beginners navigating Islamic finance.

Things get even trickier for Muslims who want to grow wealth through halal investments without compromising on Islamic values. How do I grow my money in a Shariah-compliant way — avoiding Riba as well as sticking to true Islamic finance principles? How can I invest directly in halal stocks and Shariah-compliant businesses, without relying on expensive funds?

The answer is Tabadulat, your gateway to global halal investing. We empower Muslims to take control of their money through accessible and transparent halal investments. Halal investing is not just an investing strategy — it’s a faith-based framework for investing and managing money which aligns with Islamic finance principles.

While there are similarities with traditional investing, halal investing follows key distinctions guided by Shariah compliance.

In this article, we’ll break down what Islamic finance and halal investing actually are, how they differ from traditional investing, and how Tabadulat is here to support you on your investing journey.

So…what is Islamic finance?

At its core, Islamic finance is about trading, investing, and handling money in a way that adheres to Islamic principles; rules and regulations around handling money and investments that every Muslim is obligated to follow.

In short this means no interest (Riba), no impermissible (Haram) business activities, and no excessive risk or speculation. Islamic finance is underpinned by fairness, transparency, justice, and shared responsibility.

Halal investing is built on fairness — with profit, loss, and risk shared by all parties. There’s no Riba and no guaranteed returns. Instead, your financial gains are tied to the performance of companies and real assets, making your profits more just, stable, and less risky.

When it comes to halal investing, that means putting your money into halal stocks and assets as well as avoiding anything that’s haram (or impermissible).

It sounds straightforward, right? Let’s break it down further.

What are the principles of halal investing?

- No Riba (Interest)- In Islamic finance, earning or paying interest is strictly prohibited. How come? That's because profit can’t be guaranteed-it has to come from the performance of real businesses or assets. This involves sharing profit and loss as well as risks together.

- Avoiding Gharar (Excessive uncertainty)-Gharar refers to excessive uncertainty or risk. Gharar prompts instability and potential harm in transactions, whereby one-party benefits over another. This is unjust. Therefore, investments consist of no unclear contract terms or high-risk instruments like derivatives, forwards, futures, options or other speculative products like short selling.

- Avoiding Maysir (Excessive speculation) - Gambling or speculation is not allowed. This means no high-risk derivatives, selling an asset you don’t own or other instruments based on speculation or gambling.

- Halal assets - Are companies and assets that are deemed Shariah-compliant. Investors can invest in pre-screened Halal stocks, funds, Sukuk (Islamic bonds), certain ETFs, real estate investment trusts, as well as commodities, precious metals (like gold and silver) and Shariah-compliant start-ups.

At the same time, you can’t invest in haram sectors like companies involved in selling or producing alcohol, pork, gambling, pornography, weapons or Riba-bearing financial institutions (like banks and insurance). - Zakat (Wealth purification)-a key pillar of Islam. Muslims are required to give a portion of their wealth each year to charity. Halal investing prioritises this, meaning you are not just growing your wealth but also purifying it for this life and the next.

Once you understand the core principles, you can explore the broader Halal stock market. That includes everything from Halal REITs (screened real estate investment trusts) and Halal ETFs tracking screened baskets of companies to niche instruments like a Halal gold ETF. Even if you’re drawn to sectors such as tech stocks, you can find Shariah‑compliant funds or a Halal mutual fund that bundles them. Islamic finance also allows real assets, so commodities and gold ETFs are permitted when backed by physical metal. Having these options means you don’t have to compromise diversification for faith.

How does halal investing differ from traditional investing?

On the surface, halal investing appears similar to traditional investing, both involve investing in stocks, funds, and assets with the goal of growing returns over time. Yet the intentions, filters and the overall investing philosophy are different.

So, while a traditional investor might focus purely on profit only, a Muslim investor should think about what’s behind the returns? Is it halal? Is it earned fairly? And does it align with Islamic values?

Halal investing isn’t just about Shariah compliance — it often generates solid performance too. Studies show that Shariah-compliant stocks can outperform their conventional peers while being more resilient during market volatility. A 2022 study, for example, found the FTSE All-World Shariah Index outperformed the FTSE All-World Index across most time frames, with similar levels of volatility. Why? Because halal investing filters out highly leveraged or unstable companies — and rather focuses on real and financially sound companies.

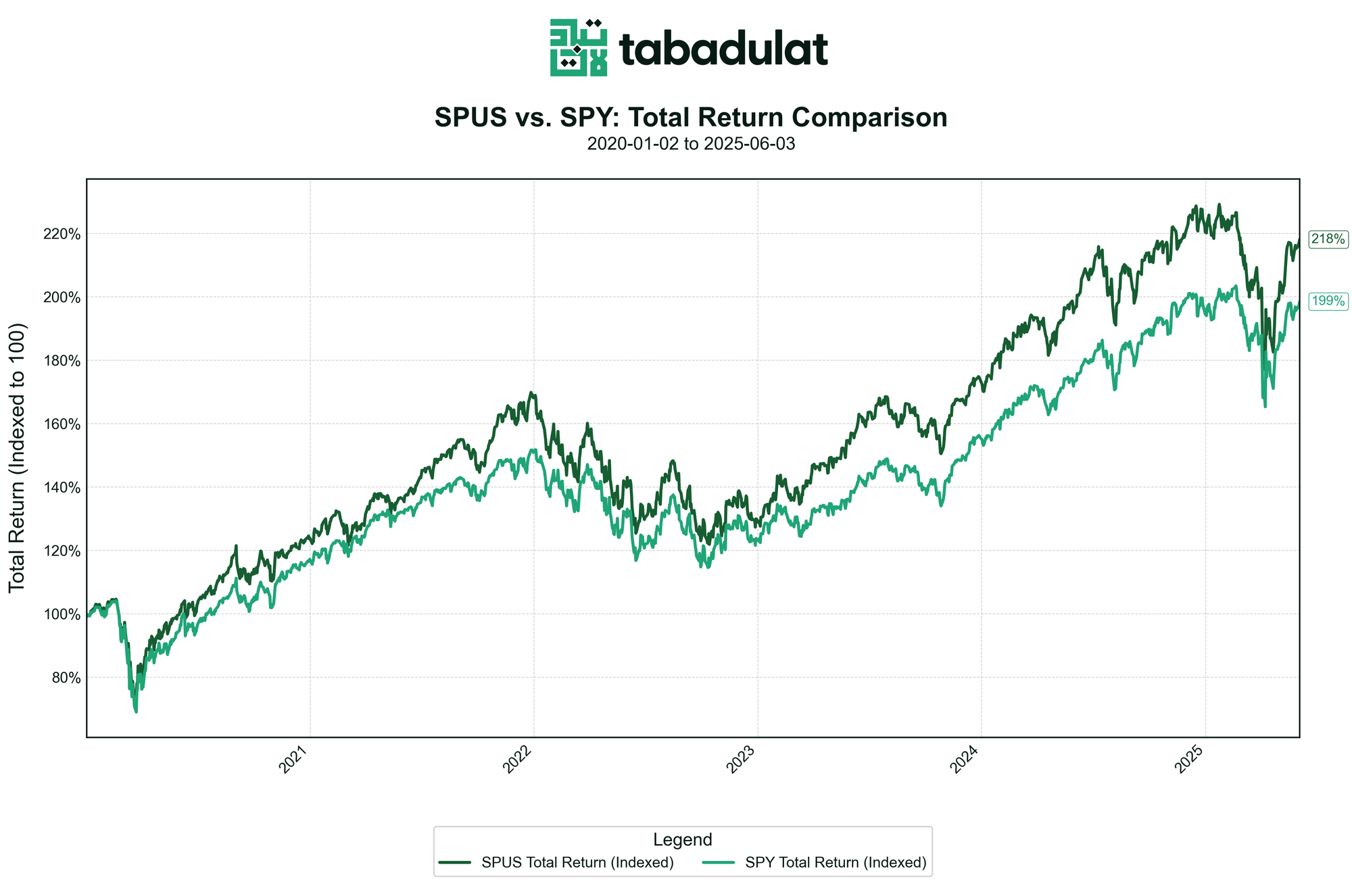

Halal companies tend to generate a higher return in bull runs and a lower drawdown in market crashes. The chart below shows the total return of the S&P 500 Index ETF (SPY) vs SPUS (a halal alternative) over a five-year period, in every time frame the halal alternative does better!

But there’s a problem.

Ok this all sounds great. But what about in practice? Unfortunately, in reality it's not easy, efficient, or cost-effective.

Diversifying isn’t just about products; it’s also about how you buy and sell. A thoughtful investment strategy should balance long‑term goals against short‑term liquidity needs, and it should consider how much of your return comes from interest income versus trade profits. For example, some investors prefer to invest in gold, owning physical gold or a screened fund, in small amounts to hedge volatility. As you weigh different options, ask yourself whether each specific investment aligns with Shariah rules, whether the financial product is interest‑based or profit‑sharing, and how it supports your overall investment decisions.

Most Islamic investment platforms hand your money over to fund managers, charging high fees and investing using dated strategies, often with sub-par results. We believe Muslim investors should be in control of their investments. That’s why Tabadulat gives you direct access to global markets with industry-leading ultra-low fees.

Right now, most brokers don’t offer halal investment tools. Or if they do, they offer it through an “Islamic” sub-account or “Islamic window” which is part of a wider and larger conventional platform, where your assets are mixed and used to generate Riba for the broker.

This means that their screening criteria is not evaluated by Shariah scholars and their fees are high (or hidden). There’s also ambiguity as to whether your money is handled and managed in a completely Riba-free manner. For example, your money could be held in an interest-bearing custody account, or lent out to other customers with interest. Your stocks could also be lent out for short selling, and your deposits used as collateral without your explicit consent.

Too often, Muslim investors are left with compromised choices. They’re either charged high fees by incumbent banks, or offered so-called “Islamic” products that don’t uphold Islamic values and serve only to mislead them. There’s also a real gap in education, support, and tools — making it hard to invest with confidence and stay true to your values. Tabadulat is here to change that.

Halal ETF and Halal Stock Screening

Enter Tabadulat. We were tired of compromises and navigating platforms that don't align with Islamic values. There’s no reason why you should be paying $150 a year just to screen stocks, or $20 per trade through Islamic banks. Muslim investors deserve better — and that’s exactly why we built Tabadulat.

We are the world's first truly global, 100% Shariah-compliant brokerage — made by Muslims, for Muslims. We aren’t just a brokerage with Shariah compliance metrics. We are built with Islamic finance principles at our core, from top-up, trade execution, and withdrawal, we ensure that the whole journey is 100% Shariah-compliant and Riba-free. Take control of your investments and rest assured that your profits are 100% halal.

Why choose us?

- Fully Shariah-compliant- We adhere to AAOIFI standards, the benchmark in Islamic finance. We will be guided by an independent Shariah Supervisory Board made up of some of the world's leading Islamic finance scholars. This means that every decision, every feature, every asset will have halal at its core.

- Halal stock screener - We screen every stock in the world in real time, that's over 40,000 stocks and ETFs every single day. If anything in your portfolio becomes non-compliant, we’ll let you know immediately- you can focus on the investing and we will handle the halal.

- Global First - Users can sign up from almost anywhere, and invest in halal certified stocks across North America, Europe, the GCC, Asia and Oceania. We also offer fractional trading, which allows you to start investing from as little as $1.

- Smart tools - We will have a suite of tools to support you on your halal investing journey:

- Charting with technical indicators

- Advanced portfolio analytics

- AI-curated market news and intelligence

- Built-in Zakat calculator based on the fundamentals of your investment

- Ultra-low and transparent fees- No hidden charges, no surprise fees. Just 25bps per trade with a $1 small fee minimum, and absolutely no Riba — ever.

So now what?

Halal investing is more than just avoiding Riba and haram industries. It’s about aligning your money with your values. It’s about growing your money with intention and peace of mind.

Ready to put these lessons into practice? Tabadulat doesn’t just show you if a stock is halal, it helps you understand why. When you sign up, check your email inbox and click confirm subscription to access the platform. From there, you can research thousands of screened stocks across major stock exchanges, compare halal and conventional indices like the S&P 500 vs SPUS, and place trades in line with Shariah principles. Our system evaluates every listing’s debt ratios and revenue mix, ensuring you never inadvertently invest in an interest‑bearing asset or one that derives its returns from riba.

At Tabadulat, we’re here to make your halal investing journey cost-effective and accessible. Whether you’re just starting out or you’re a seasoned investor, Tabadulat has got you covered — no shortcuts, no compromises.

Sign up today for early access!

FAQs

What is Halal investing and how is it different from conventional investing?

Halal investing follows Islamic principles, no interest, no excessive uncertainty, no speculation and focuses on Shariah‑compliant assets with profit‑and‑loss sharing and zakat obligations. Conventional investing may involve interest‑bearing products and haram sectors.

How can I tell if a stock is Halal?

Check both the company’s business activities and financial ratios. Avoid firms with riba‑based debt or significant impermissible income. Tabadulat screens over 40 000 stocks and ETFs daily and notifies you if a holding becomes non‑compliant.

Are ETFs Shariah compliant?

Some ETFs are halal to invest in if they track Shariah‑compliant companies and avoid interest‑based structures. For example, SPUS is a halal alternative to the S&P 500 ETF. Always verify that the underlying assets meet Islamic criteria.

What is the best Halal stock screener?

Apps like Zoya and Musaffa provide basic halal stock screening, but Tabadulat screens more than 40 000 stocks and ETFs daily, delivers deeper Shariah‑compliance insights via an independent board, and is completely free to use

How does Tabadulat ensure Shariah compliance?

Tabadulat adheres to AAOIFI standards, has an independent Shariah board, screens more than 40 000 stocks and ETFs in real time, and provides alerts if your portfolio becomes non‑compliant. It also includes a built‑in zakat calculator.

What are Halal REITs?

Halal REITs invest in Shariah‑compliant property like residential or healthcare assets, avoid riba‑based financing and ensure non‑halal income stays below 5%. Tabadulat’s screener can help you filter these REITs and monitor compliance.

What are Halal mutual funds?

Halal mutual funds pool money to buy screened equities; their permissibility depends on the holdings and management practices. Funds like Amana Growth meet these criteria. Use Tabadulat’s screener to compare and identify Shariah‑compliant mutual funds.